50 tasks in 3 years to stabilise economy

Govt pledges to take huge reform measures for IMF loans

The government has pledged to take more than 50 reform measures in three years under the International Monetary Fund’s loan programme to rebuild foreign currency reserves and contain inflation.

“Our reform agenda under the IMF programme aims at restoring macroeconomic stability and undertaking structural reforms to promote inclusive and green growth,” it said.

The measures have been included in the Memorandum of Economic and Financial Policies (MEFP) that Bangladesh submitted to the Washington-based lender before the proposal for the $689 million loan was placed at the board meeting of the lender last week.

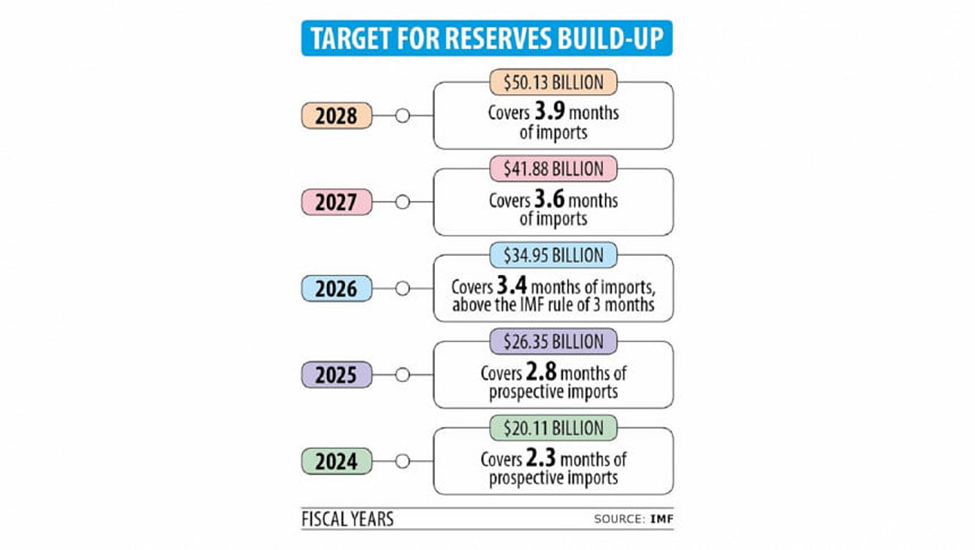

During the remaining programme period covering the current financial year of 2023-24 to 2025-26, the government plans to bring down inflation to within the range of 5 percent to 6 percent and increase the gross international reserves (GIR) to about four months of prospective imports by FY26.

Helped by continued monetary policy tightening and a neutral fiscal stance, inflation in Bangladesh is projected to moderate to 7.25 percent year-on-year in FY24.

Owing to higher commodity prices in the international market and their adjustments in the local markets as well as inadequate policy measures, inflation has still stayed above 9 percent.

The Consumer Price Index rose 9.42 percent in November. It was 9.02 percent in FY23.

Amid higher import bills against moderate remittance and export receipts, the GIR slipped to $24.3 billion in the last financial year from $36 billion in 2019-20, which could cover import bills for 3.4 months in FY23 compared to 6.1 months in FY20.

The reserves stood at $19.17 billion on Thursday.

The MEFP says it would take measures to liberalise further the exchange rate and the interest rate on bank loans. However, it did not say categorically whether the rates will be fully market-based.

According to the plan, the government will analyse existing tax subsidies, known as tax expenditures, in the areas of corporate taxes, personal income taxes, and value-added taxes, and publish the analysis as part of the FY25 budget.

“We will use the analysis to identify measures to rationalise tax expenditures, which will be adopted in our FY25 and FY26 budgets.”

The tax expenditure refers to the rebates, discounts, exemptions, reduced rates of taxation and exclusion of income from computing total taxable income.

The total amount of tax subsidies stood at Tk 1,78,241 crore in FY23, up more than 41 percent from Tk 1,25,813 crore in FY21, which accounted for 3.56 percent of the gross domestic product.

The MEFP said it will formulate a medium- and long-term revenue strategy (MLTRS) to provide a structured framework to improve revenue collection over the next four to six years.

Stakeholder consultations are expected to be completed in early 2024 and the strategy will be finalised by June next year.

The government said it is committed to containing subsidies to safeguard priority spending.

It plans to eliminate all structural subsidies for petroleum products and move to a periodic formula-based price adjustment mechanism.

It will submit the selected mechanism for approval to the prime minister by this month and implement it by March 2024.

“Furthermore, we will aim at adjusting electricity prices and remain committed to not including capacity charges, in the case of renewing the contract, to power producers to further reduce subsidies.”

The government will further strengthen project selection by rolling out the Sector Strategy Papers and Multi-Year Public Investment Programme tools in five sectors by 2024 and another five sectors by 2025.

A maximum of five capital projects will be identified that will be pursued in each sector.

As part of its plan to minimise borrowing costs, the government will cut reliance on national savings certificates (NSCs) and shift more towards concessional sources of external financing in the medium term while Bangladesh remains eligible for them.

“Developing local bond markets will allow us to gradually tap into long-term market financing,” the MEFP said.

The government has already developed a formal plan on how to sustainably keep the net NSC issuance below one-fourth of net domestic financing by FY26.

The government is working to improve transparency over state-owned enterprises (SOEs).

It has collected recent financial data on more than 120 SOEs through an online portal and is conducting a thorough analysis of the financial health of a subset of the SOEs to come up with a fiscal risk statement, an annual SOE sector report (initially covering the 50 largest SOEs), and an SOE governance framework.

The MEFP says the government will further improve the statistics of distressed assets to align with international best practices.

It aims to issue a circular by March 2024 to treat material exposures as non-performing when they are more than 90 days past due.

In order to reduce bank balance sheet weaknesses, particularly of the state-run commercial banks, the government developed bank-specific roadmaps to reduce the average NPL ratio to below 10 percent for SCBs.

Currently, it is drawing up roadmaps for private commercial banks (PCBs) to reduce NPLs to below 5 percent by 2026.

These roadmaps will also aim to increase capital adequacy ratios and provisioning coverage of SCBs to 10 percent and 100 percent of required provision and of PCBs to 10 percent and 100 percent by 2026.

In a letter to the IMF, Finance Minister AHM Mustafa Kamal said the updated programme will continue to be centred on upfront policy actions aimed at restoring macroeconomic stability and rebuilding the reserve buffer.

“We believe that our commitments, as outlined in the MEFP, are adequate to achieve programme objectives, but we are prepared to take additional measures, as appropriate, for this purpose.”