Tk100cr booster dose planned for 46 startups

The board of directors of Startup Bangladesh has approved proposals to invest in 11 startup companies named Sajgoj, Jahazi, Dana-FinTech, Hisab, Bari Koi, Onno, Loosely Coupled, Alice Labs, Wigro, Seba Platform Limited, and Fabric Lagbe. Contracts for an investment of Tk18 crore in these 11 companies are under process.

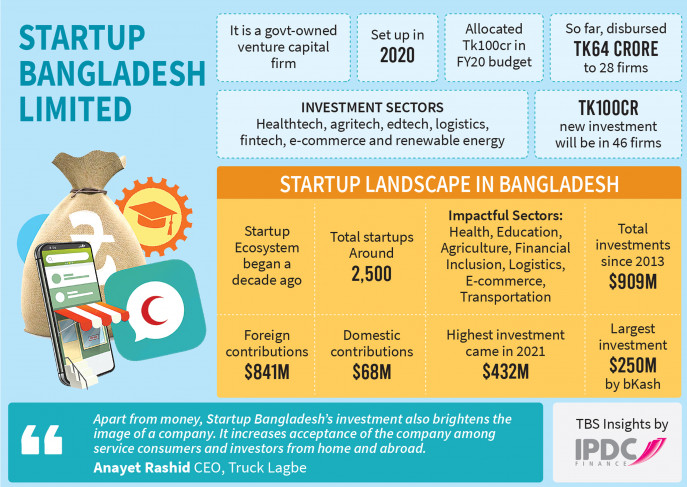

Government-backed venture capital firm, Startup Bangladesh Limited, is set to inject a fresh Tk100 crore into the growing startup sector of the country. The company aims to channel this new investment into 46 selected startup enterprises.

Managing Director of the firm Sami Ahmed, in a recent communication to the Ministry of Finance, has formally requested the allocation of funds for this purpose.

Since its inception in 2020, Startup Bangladesh has already greenlit investments totaling Tk73.50 crore across 28 diverse companies. Of this sum, Tk64 crore has already been disbursed. These strategic investments span various sectors including healthtech, agritech, edtech, logistics, fintech, e-commerce, and renewable energy.

Anticipating further growth, the company now envisions extending its support to additional startups of similar types. In his letter to the Finance Division, Sami articulated the necessity of an additional Tk100 crore to sustain the momentum of ongoing investments and to facilitate the seamless execution of the company’s activities. The appeal for fresh funds includes a comprehensive breakdown of the past investments, specifying the sectors and amounts involved.

A senior official from the Finance Division said that a policy decision has been made to allocate the required finances to meet the escalating investment demand of Startup Bangladesh. The official assured, “The funds will be released immediately,” signaling a proactive approach to fortifying the startup ecosystem in the nation.

“Apart from money Startup Bangladesh’s investment also brightens the image of a company. It increases the acceptance of the company among service consumers and investors from home and abroad.”

By Truck Lagbe CEO Anayet Rashid

The companies that have received investments from this government venture capital firm say that the investment of Startup Bangladesh has increased their financial capacity as well as the acceptability of the company to domestic and foreign customers and investors.

In March 2020, Startup Bangladesh embarked on its official journey, registering under the Company Act with an initial paid-up capital of Tk7 crore. Initially set at Tk50 crore, the organization’s authorized capital has since been elevated to Tk500 crore.

The funding from the government is expected in tranches as the capital gets invested in startups, said Sami, adding that, initially, the company received Tk50 crore from the Finance Ministry, which has already been invested.

“We have subsequently submitted our investment report to the finance ministry to secure the next tranche of Tk100 crore from the allocated capital.

“For companies that have previously received investments in their seed or growth stages, the economic impact is substantial. These startups have grown and expanded their operations, hired additional talents, and introduced innovative products and services to the market.”

This, in turn, fuels economic growth and solidifies our position as a centre for technological innovation, he said. “Notable achievements resulting from our investments include providing academic and technical learning to over 2.5 crore students, serving more than 5 crore customers with their products and services, and creating over 15,000 direct jobs along with over 300,000 indirect employments to name a few. Some startups have expanded their business overseas generating revenues from foreign countries.”

Companies that have been approved for new investments

The board of directors of Startup Bangladesh has approved proposals to invest in 11 startup companies named Sajgoj, Jahazi, Dana-FinTech, Hisab, Bari Koi, Onno, Loosely Coupled, Alice Labs, Wigro, Seba Platform Limited, and Fabric Lagbe. Contracts for an investment of Tk18 crore in these 11 companies are under process.

In addition, the approval process is underway for an investment of about Tk75 crore in 35 more startups. Furthermore, Tk9.5 crore will be invested in 11 institutions that have been approved before, but the money has not been transferred. These investments will require Tk100 crore to complete. This company has an investment strategy and process. Investment decisions are made through the company’s portfolio, business due diligence, recommendation of the Investment Advisory Committee, and approval of the board.

Companies that have received investment

The largest investment has been made in Chaldal Limited. Tk9.98 crore has been invested in this grocery items company followed by Intelligent Machines ltd that received Tk5.49 crore in investment.

10 MS Limited, Sheba Platform Ltd, Tour Booking Bangladesh Ltd, Care Nutrition Ltd, SWAP BD Ltd, Truck Lagbe Limited and Steller Digital Ltd each have been received Tk5 crore. Tk4.25 crore has been invested in the ride-sharing company Pathao. Startup Bangladesh has invested Tk3 crore in Silver Water Technologies Bangla.

Zantrik Limited, Shuttle Technologies BD Ltd, Loop Freight Ltd, Vroom Service Ltd, BIMAFY Ltd, OpenRefactory Bangladesh Ltd, AmarLab Limited, I-Farmer Limited, Marketeer AI Ltd, Arogga Ltd, MedEasy and Pavillion, Adeffi have each been invested with Tk1 crore.

In addition to the above, Tk50 lakh has been invested in Dhakacast, Tk75 lakh in Tech Hive Ltd, Tk75 lakh in Moner Bondhu and Tk75 lakh in HelloTask Platform Ltd.

Anayet Rashid, CEO of Truck Lagbe, told that Startup Bangladesh’s investment in a startup company is creating various benefits. “Apart from money Startup Bangladesh’s investment also brightens the image of a company. It increases the acceptance of the company among service consumers and investors from home and abroad.”

He said that startup companies that have emerged in various sectors are doing new types of business. “Many existing laws and regulations are creating obstacles to the work of startups. Again, in many cases, new types of legal assistance are needed. Startup Bangladesh is also helping in the activities by formulating and changing laws and policies for this sector.”

Future investment plan

Startup Bangladesh is working to create five unicorns by 2025. At the same time, the company wants to invest Tk500 crore in 150 investments during the period. In addition, if the government approves, the company wants to establish and manage a venture capital fund, private equity fund, impact investment fund, and fund of funds. The company has informed the finance department that it will be possible to earn income from management fees from these funds.

About Startup Bangladesh Limited

In March 2020, the company initiated formal operations after registering under company law with a capital of only Tk7 crore. The ownership of this company lies with the Bangladesh Computer Council. Although the initially-approved capital of the company was Tk50 crore, it has currently been increased to Tk500 crore. In the fiscal year 2019-20 budget, the government allocated Tk100 crore for startups, which Startup Bangladesh is authorised to utilise as a fund. In January 2022, Tk50 crore was released from the allocation by the Ministry of Finance.

This company invests in new startup ventures in the non-governmental sector through equity. It invests a maximum of Tk1 crore in the seed stage and up to Tk5 crore in each round of the growth stage. Additionally, it provides necessary advice. It establishes connections between domestic and international investors and relevant organisations.

Success in startup companies is not easy. Venture capital investors globally acknowledge that 90% of startups fail, and only 10% become profitable. However, the returns from these profitable companies are significantly higher, outweighing the investment losses in 90% of unsuccessful ventures.

Startup activities in Bangladesh

The startup ecosystem in the country is just about a decade old. Currently, there are approximately 2,500 active startups in the country. Startups have brought about significant changes in various sectors, including health, education, agriculture, financial inclusion, logistics, e-commerce, and transportation.

Foreign investments are flowing into the country through startups. Since 2013, 377 startup companies have received investments amounting to $909 million, with foreign investments contributing $841 million. The remaining $68 million came from domestic investors, indicating that only 7% of the investment in startups is local. In 2021, the startup sector attracted the highest investment, reaching $432 million. During that year, mobile financial services company bKash secured a $250 million investment.