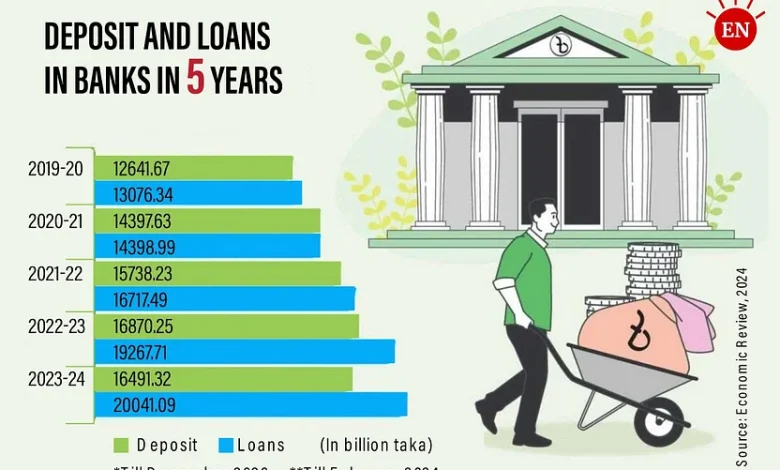

Bank loans cross Tk 20,000b

Loans in the public and private sectors under the banking system have increased by Tk 7000 billion more than the amount five years ago as the total loans have crossed Tk 20,000 billion.

Bank deposits have also increased significantly.

The bank deposits were Tk 17500 billion till December 2023. Deposits have increased by Tk 5000 billion compared to five years ago.

So the growth in bank loans is higher than the deposit in the country.

The amount of loan is higher as the loan that is disbursed is not returned in many cases. However, the banks have to show the statistics. As a result, the amount of loans becomes big.

Former Bangladesh Bank governor Saleh Uddin Ahmed

This picture has been found in analysing Bangladesh Economic Review-2024. The finance division of the finance ministry placed the review report in the parliament on 6 June.

As per reasons behind the higher loans, statistics of investment has been included in the loans. Investment mainly means the lending that a bank gives to another bank, again this money is used in the government sector as loans. So net investment is not net loans.

The information of deposit has been mentioned till December 2023 and loans till February 2024.

Persons involved in preparing the economic review said the picture could become a bit different if the information of deposit was available till February this year. The complete picture would be available when the new economic review will be published in December next.

Generally loans cannot be higher than the deposits. However, in many cases, out of bank deposit, the government prints money and takes loans. These statistics remain out of deposit. In that case, the amount of loans may be higher.

As per reasons behind the higher loans, statistics of investment has been included in the loans. Investment mainly means the lending that a bank gives to another bank, again this money is used in the government sector as loans. So net investment is not net loans.

According to the review, Tk 1000 billion as deposit is increasing every year. But loans are increasing about Tk 1500 billion every year. Meanwhile, one-third of total deposits has come as fixed deposit receipt (FDR). One-fourth of loans has gone to the government.

According to an economic review, total deposits stood at 17,491.32 billion till 31 December 2023. The disbursed loans till February stand at 20,041.09 billion. The deposit was Tk 12,641.67 billion five years ago. The loans were Tk 13,076.34 billion.

Information of loans both in the public and private sectors have been mentioned in the review. The government had loans of Tk 427,1.72 billion in the banking sector till February of the current fiscal year. But the amount of loans was Tk 210,3.66 billion five years ago.

On the contrary, loans in the private sector till February stand at Tk 15,76,9.36 billion, the amount was Tk 10,972.68 five years ago.

Association of Bankers Bangladesh (ABB) chairman and BRAC Bank managing director Selim Reza Farhad Hossain, speaking to Prothom Alo, said in reality the pace of growth of both deposit and loan has decreased.

He also said the growth of loan is a bit higher as some people are trapped in compound interest while some have been victimised by depreciation of taka. As a result, many are not paying loans and bad loans instead of good loans are increasing in the banking sector.

One-third deposit in FDR

According to the economic review, there were 16 types of accounts for keeping deposits in the banks. There are currently 14 types of accounts. Taking the six months of the current fiscal year into consideration, it is found that the highest amount of deposit is received from FDR. There are five categories of FDR. These are three to six months, six to one year, one year to two years, two years to three years and over three years.

A total of Tk 7,76,9.70 billion have been deposited till 31 December 2023. The amount of such deposits was Tk 5,656.25 billion five years ago, 30 June 2020.

Of the five categories of FDR, the highest amount of Tk 3390.82 has been deposited for three to six months. The second highest of Tk 2344.04 billion has been deposited for one to two years. The third highest of Tk 1155.54 billion has been deposited for six months to one year.

Besides, the deposit in FDR over three years was Tk 781.75 billion and the lowest amount of deposit in FDR for two to three years was Tk 137.54 billion.

Two notable bank accounts are savings accounts and current accounts. The banks have received Tk 3749.19 billion as savings deposit and Tk 155,7.49 as current deposit. Many banks have pension schemes. The banks receive Tk 1171.88 as pension deposit.

When asked about why the loans are higher than the deposits, former Bangladesh Bank governor Saleh Uddin Ahmed said the amount of loan is higher as the loan that is disbursed is not returned in many cases.

However, the banks have to show the statistics. As a result, the amount of loans becomes big.