Financial account deficit balloons to $5.39b as foreign loans shrink

Central bank data shows the financial account deficit widened to $5.39 billion in the July-November period of the fiscal 2023-24, which was a $1.26 billion surplus during the same period in the last fiscal year.

While the country’s current account balance exhibits a positive trend and trade deficit narrowed in five months of the current fiscal year to November, the financial account dipped further into negative territory, leaving the external balance still in stress.

Central bank data shows the financial account deficit widened to $5.39 billion in the July-November period of the fiscal 2023-24, which was a $1.26 billion surplus during the same period in the last fiscal year. November’s deficit surged by a staggering $1.37 billion from October.

During the period, the current account remained surplus by $579 million with $347 million added in November alone, marking a massive turnaround from a whopping $5.66b deficit in the same period a year ago.

The country’s first five months of the current fiscal year witnessed a significant narrowing of the external trade deficit, down nearly 60% compared to the previous year.

Central bank data shows the trade deficit for FY24 (July-November) stood at $4.76 billion, less than a half of $11.82 billion in the same period of FY23.

Exports fetched $5.31 billion in December, highest in a month in the entire year, while inward remittance reached $1.99 billion in the last month of 2023, according to latest official data. December imports data have not yet been released.

The financial account, a key component of a country’s balance of payments, covers claims or liabilities to non-residents concerning financial assets and its components include foreign direct investment, medium and long-term loans, trade credit, net aid flows, portfolio investment and reserve assets.

The financial account was $2.1 billion in deficit at the end of FY23, in contrast to a $15.5 billion surplus in FY22.

Professor Dr Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue (CPD), told that despite a trade deficit, Bangladesh’s current account remains positive this fiscal year. He attributed this to the dollar rate being in sync with the market to some extent, which slightly increased remittances and exports.

He said increased exports and remittances eased reserve strains to some degree but boosting foreign loans and aid is crucial to address the substantial financial account deficit.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, flags the unusual financial account deficit and calls for boosting foreign fund inflows through revitalised foreign direct investment (FDI), a vibrant capital market, and enhanced remittance and export earnings.

“If the capital market is vibrant, more foreign capital investment will flow,” he added.

According to central bank data, Bangladeshi businesses repaid $5.21 billion more in principal and interest for short-term foreign debt than loan receipts from January to November of 2023.

The additional repayment of external debt is putting fresh pressure on the dollar liquidity and dwindling foreign exchange reserves in the country. At the same time, the financial account deficit is widening as foreign loans are not flowing in at the same pace, said bankers.

Bangladeshi businessmen received short-term private sector foreign loans amounting to $23.70 billion in the January-November period while their repayment of loan and interest amounted to $28.92 billion.

Central bank data reveals a 14.5% decline in foreign direct investment (FDI) inflows to $1.84 billion for July-Nov of FY24 compared to the same period last year.

Medium and long-term (MLT) loans reached $1.87 billion in July-November of FY24 which was 20.7% higher in the same period of FY23. Short-term trade credit (net) also saw a significant decline of $5.37 billion in July-November of FY24 compared to the same period of FY23.

Trade deficit narrows by 60%

The country’s first five months of the current fiscal year witnessed a significant narrowing of the external trade deficit, down nearly 60% compared to the previous year.

Bankers attributed this improvement, amidst ongoing dollar market challenges, to import restrictions and relative export growth implemented to protect foreign exchange reserves.

Central bank data shows the trade deficit for FY24 (July-November) stood at $4.76 billion, compared to $11.82 billion in the same period of FY23, central bank data said.

In the five months of FY24, the country’s exports stood at $20.96 billion, an increase of only 1.19% over the previous fiscal year.

At the same time, imports reached $25.72 billion in the first five months of FY24, which is a 20.94% decrease compared to the same period of the previous financial year.

Current account surplus $579m

Five months into FY24, the current account sees a remarkable turnaround with a surplus of $579 million, a stark contrast to the $5.66 billion deficit in FY23, with November alone contributing a $347 million jump.

The current account balance is the primary source of a country to make foreign payments. When a country’s current account balance turns negative, it first uses its financial account to make foreign payments. If the financial account also becomes negative, the country then uses its reserves to make foreign payments.

Bankers said the current account remains positive due to lower imports compared to exports, and there has been a positive trend in the flow of remittances over the last few months.

Remittances are increasing as many banks offer higher rates than the official rate to address the dollar crisis.

Currently, the dollar rate for remittances and export proceeds is fixed at Tk109.50. However, some banks collected remittances at Tk120-24, bankers said.

The country’s remittances reached $1.99 billion in December 2023, marking a 17% increase compared to the same month of the previous year and representing the highest figure in the last six months.

Additionally, in December, exports amounted to $5.30 billion, the highest in the last 12 months.

As of 27 December 2023, Bangladesh’s foreign exchange reserves, as per BPM-6, stood at $21.44 billion, compared to $19.52 billion as of 28 November.

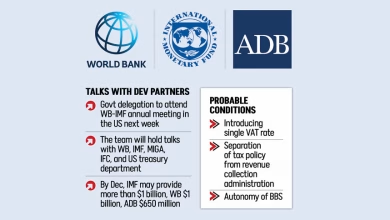

The country’s reserves increased after obtaining loans from the International Monetary Fund and the Asian Development Bank in December. Additionally, the Bangladesh Bank purchased $1 billion from several private banks.