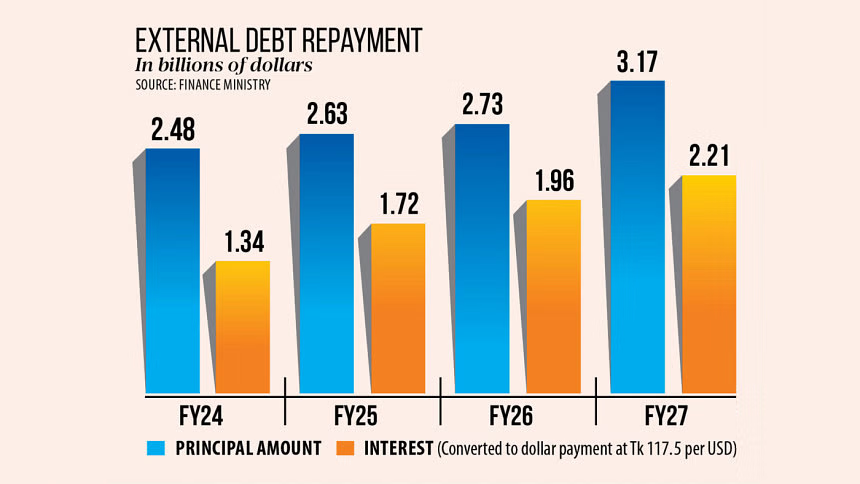

Foreign debt costs to spiral

Interest payments to surge 65pc to $2.21b by 2027

Bangladesh’s interest payments on external borrowing are projected to soar by 65 percent within three years due to rising global interest rates and an expanded foreign loan portfolio, which will put further pressure on the dwindling foreign currency reserves.

According to a finance ministry report, the interest payments will rise to $2.21 billion or around Tk 26,000 crore by 2027 with the taka losing 35 percent of its value against the greenback over the last two years.The principal amount is also forecast to jump by 28 percent to $3.17 billion in fiscal 2026-2027, compared to the current fiscal year.

Foreign loan repayments, including interest and principal amount, are projected to reach $3.82 billion in the current fiscal year. Foreign debt servicing already stood at $2.81 billion in the first 10 months of the fiscal year. The amount will rise to $5.38 billion by 2027.

“The impact of currency depreciation on external debt levels underscores the need for careful monitoring and management of external debt risks to maintain economic stability and resilience,” said the report titled Medium-Term Macroeconomic Policy Statement (MTMPS).

The proportion of external interest payments in the budget is also expected to rise to 2.6 percent in FY27 from 0.9 percent in FY22, reflecting a growing impact of external debt on the budget, the report mentioned.

It further said two major factors are contributing to the increase in interest payments for foreign loans.

One factor is that the reference rates in advanced countries are expected to stay high, and the other is that Bangladesh’s graduation from the category of LDCs will gradually narrow the window for getting concessional loans from external sources.

A reference rate is an interest rate benchmark that is used to set other interest rates. The Fed Funds Rate, the Secured Overnight Financing Rate (SOFR), and the prime rate are among the most common reference rates.

The report said the implicit interest rate on external borrowing exhibits a gradual increase over the period — from 1 percent in FY21 to 2.6 percent in FY27.

“This increase is attributed to a higher proportion of borrowing through floating and semi-concessional rates, which are more sensitive to market fluctuations compared to fixed-rate financing.”

It also mentioned that the depreciation of the taka has elevated the value of external debt when measured in local currency terms.

This highlights the influence of currency fluctuations on the debt portfolio and the importance of managing external debt exposure in the face of exchange rate volatility.

Referring to the gradual increase in foreign loan repayments, the report said that managing these debt service obligations is essential for ensuring financial stability and preventing liquidity crises.

“Despite the increasing amounts of external debt repayment, they are expected to remain within tolerable limits, supported by the government’s efforts to diversify funding sources and build up foreign exchange reserves,” it added.

Talking to this newspaper, Ahsan H Mansur, executive director at the Policy Research Institute of Bangladesh, said that given the ongoing forex crisis, Bangladesh has to be judicious about taking loans and choose projects that are of high social and economic importance.

“Many of the investments were good, but many were not, which is why our debt burden is rising. The government’s capacity to borrow is decreasing due to the inability to expand revenue growth in line with economic growth.”

He said projects such as the Dhaka Metro Rail and even an underground rail line in Dhaka will be beneficial.

However, the huge spending on the train line to Cox’s Bazar, the Padma Rail Line, and the nuclear power plant in Rooppur will not yield expected outcome. They will add to the burden of foreign debt repayment, he said.

According to the report, Bangladesh’s foreign loans are mostly made up of five currencies. The US dollar remains predominant, constituting 53 percent of the total, followed by the Japanese yen at 20 percent, the euro at 15 percent, the Chinese renminbi at 8 percent, the British pound at 3 percent, and other currencies making up 1 percent of the debt.