Foreign loan commitment surges 1,170% but disbursement slumps

Debt servicing rises 51% in Jul-Nov

Foreign loan pledges to Bangladesh have scaled new heights, yet disbursements are dwindling and debt servicing burdens are steadily increasing, as indicated by data from the Economic Relations Division (ERD).

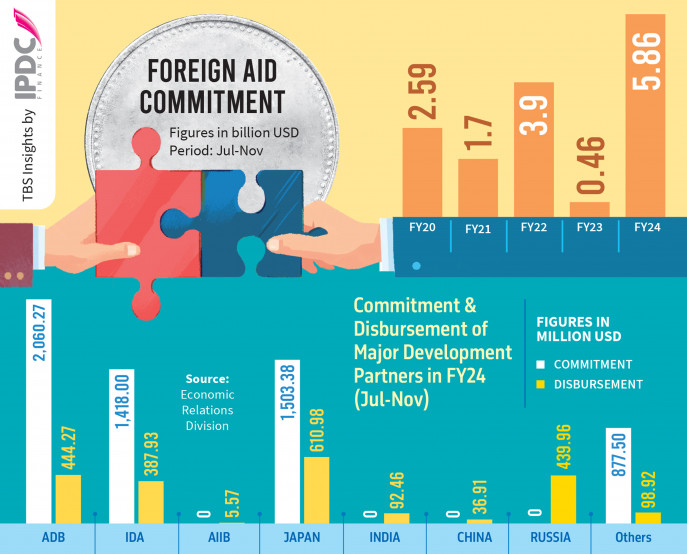

Bangladesh secured a remarkable 1,170% increase in foreign loan commitments – surpassing $5.85 billion – in the July-November period of the current fiscal year compared to the corresponding period last year, which indicates development partners are feeling confident to provide financial support to the country.

On the other hand, the disbursement of foreign loans has seen a downward trend and debt servicing has surged which is creating pressure on the country’s diminishing foreign exchange reserves and posing challenges in maintaining a stable balance in international payments.

Data from the ERD reveals a 14% decrease in foreign loan disbursement to approximately $2.12 billion from July to November in the current fiscal year. In contrast, debt servicing has surged by 51%, reaching $1.33 billion during the same period.

ERD officials said development partners readily approved loans for numerous projects in the first quarter of this fiscal year due to the ERD’s efficient initial groundwork. This stands in stark contrast to last year’s sluggish initial progress caused by insufficient preparation.

Zahid Hussain, former lead economist of the World Bank’s Dhaka office, said while the surge in commitment is promising, the real test lies in effectively deploying these funds.

He said the new projects’ funding has been secured through development partner commitments, whose subsequent impact on public investment will be dependent on the implementing agencies’ readiness for effective expenditure.

Project implementation remains stagnant in our country, a reality that development partners now clearly recognise. Mere promises will not unlock disbursements; improved implementation capacity is the key, the economist said.

“Unless we address this critical issue, the pledged money will languish in the pipeline, failing to contribute to our development,” he added.

Asked why foreign loan commitments soared, Zahid Hussain said, “We can observe a shift in development partners’ priorities, with climate change, environment, agricultural support, and social security sectors attracting increased loan commitments.”

Following the Marrakesh climate conference, the International Monetary Fund (IMF) signalled a significant shift in focus through its announcement: a dedicated platform for climate finance in Bangladesh, he said.

This platform brings together key players like the World Bank and highlights their role in channelling resources towards climate-related projects, the economist said, adding that this strategic move seems to have borne fruit, judging by the noticeable rise in climate-related project commitments from development partners.

According to ERD data, Bangladesh aims to secure $10.2 billion in pledges from various development partners in FY24. Out of this, 57.3% of commitments were realised in the first five months.

Last fiscal year, Bangladesh received $8.79 billion in foreign loan commitments from development partners.

Why disbursement declines

ERD officials said limited implementation capacity within government ministries and departments is the prime reason for delays in loan disbursements.

Several initiatives are taken every year to increase foreign loan disbursements. Like every year, a tripartite meeting between ERD, implementing agencies and various development partners including ADB, World Bank, and the Asian Infrastructure Investment Bank (AIIB) was held where the complexity of project implementation was discussed. But still, the release of funds for many projects remains either sluggish or stagnant.

Dr Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development (InM), told TBS that there is a mismatch between the stringent conditions attached to foreign loan projects and the government agencies’ capacity to fulfil them. This pre-existing challenge is further amplified by the current political climate, with the upcoming general elections creating a rushed work environment in ministries and departments, potentially hindering effective project implementation.

Furthermore, a confluence of economic difficulties, including high inflation and a forex reserve crisis, has significantly slowed down the implementation process of certain projects, contributing to the decline in foreign loan disbursement, said Mujeri, who is also the former director general of Bangladesh Institute of Development Studies (BIDS).

ERD data reveals a dip in foreign loan disbursements from a record $10 billion in FY22 to $9.26 billion in FY23. However, the current fiscal year’s disbursement target of $11.2 billion indicates ambitious plans for accelerated financial support.

Debt servicing burdens on the rise

The expiration of loan repayment holidays (grace period) for several major projects, along with rising interest rates and economic slowdown in the global market, has intensified the pressure to repay foreign debt.

ERD officials said the start of principal payments for major projects, like the Bangabandhu Sheikh Mujibur Rahman Tunnel, following the end of their grace periods, is a key factor behind the surge in debt servicing.

Principal payments on foreign loans surged 20% during the July-November period of the current fiscal year compared to the same period in the previous year.

Adding to the economic complexity, the government’s market-based loans have risen, accompanied by a spike in floating interest rates.

Two years ago, the Secured Overnight Financing Rate (SOFR) interest rate on market-based loans was below 1%, but it has now surged by 5%. This surge has escalated pressure on foreign debt repayment, leading to a 136.5% increase in interest payments during the July-November period of the current fiscal year compared to the same period in the previous year.

Who pledged what?

In the July-November period of FY24, Bangladesh secured significant loan commitments from development partners, with the Asian Development Bank (ADB) leading the way with a $2.06 billion commitment. Japan followed closely with $1.5 billion, while the World Bank pledged $1.41 billion.

However, in terms of actual disbursements, Japan takes the lead. Japan International Cooperation Agency (Jica) released $610.98 million in July-November. Closely behind are the ADB at $444.27 million, Russia at $439.96 million and the World Bank at $387.93 million.