Govt’s interest expenses jump

The government’s expenses on interest payments rose 22.14 percent year-on-year to Tk 92,538 crore in the last fiscal year due mainly to a higher cost of borrowing.

The expenditures were Tk 75,759 crore in 2021-22.

The outlay was higher than the annual target because of a spike in interest rates for government securities, according to the quarterly debt bulletin of the finance ministry.

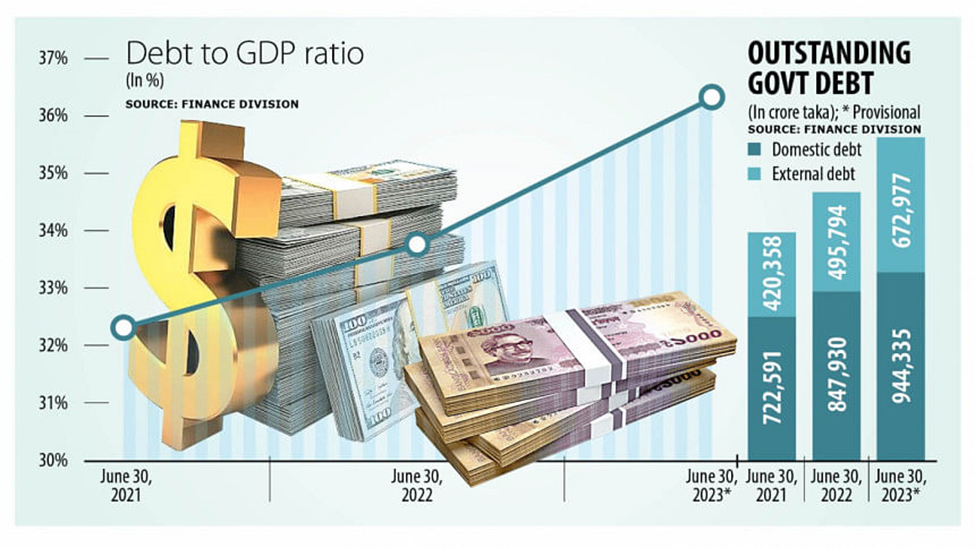

At the end of 2022-23, the total outstanding debt of the government stood at Tk 16,17,312 crore. Domestic debt amounted to Tk 944,335 crore and the outstanding external debt was Tk 672,977 crore.

Of the interest expenses, Tk 83,086 crore was paid against domestic debts and the rest Tk 9,452 crore to service the loans secured from the external sector, said the bulletin.

Among the local sources, the government repaid Tk 30,290 crore as interest against debts with the banking sector, Tk 44,800 crore against national saving certificates (NSCs), and Tk 7,996 crore against borrowing from provident funds.

Treasury bills and bonds are one of the major tools the government uses when it comes to borrowing from the banking sector. The interest of government securities has gone up recently due to a liquidity shortage in the banking sector.

The ongoing volatility in the foreign exchange market, which saw the depletion of the reserve by about 25 percent and the taka lose its value by 28 percent against the US dollar since January last year, is also another major factor contributing to the liquidity shortage.

The average yield of treasury bills went past 7 percent in November compared to 6 percent to 7 percent previously.

The total debt-to-GDP ratio was 36.34 percent based on the gross domestic product projection for FY23 by the Bangladesh Bureau of Statistics and is significantly lower than the International Monetary Fund’s threshold of 55 percent.

The gap between the debt from the banking source and the borrowing from the non-bank source has decreased, said the bulletin. However, the debt-to-GDP ratio continues to rise. In 2021-22, it was 33.79 percent.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said the interest expenditure of the government increased due to three factors: the rising interest rate, the sharp depreciation of the taka, and the increased borrowing.

“The interest expenditure of the government is increasing faster than the revenue growth, which is a challenge,” said the economist, adding that the total debt is four times the total revenue collection.

In FY23, the government borrowed Tk 1,72,285 crore from both domestic and external sources, down 4.04 percent from Tk 1,79,550 crore a year ago.

Of the loans, Tk 101,714 crore came from the local source and Tk 70,572 crore from the external source.

However, borrowing from the sales of NSCs contracted, with the net borrowing being negative at Tk 3,296 crore.

Various reform initiatives such as the online issuance process, a logical investment limit, and the introduction of multiple interest rates have contributed to the decline of the net sales of the savings instruments, said the bulletin.

The government has set an annual borrowing target of Tk 20,000 crore through the sales of NSCs.

According to the document, the government’s external borrowing was 15.80 percent lower than the target of Tk 83,819 crore in the last financial year.

The government owes Tk 507,763 crore to the banking sector and Tk 436,572 crore to the non-banking source.