Harsher bilateral loans set to make external debt repayment tougher

Bilateral loans are typically less flexible than multilateral loans, meaning that Bangladesh may have less room to negotiate terms or reschedule payments if needed.

Bangladesh is facing the prospect of an increased pressure on its balance of payment from a surge in debt repayment burden in coming years as foreign borrowing is seeing a rapid shift from flexible multilateral loans to stricter bilateral ones.

Bilateral loans are typically less flexible than multilateral loans, meaning that Bangladesh may have less room to negotiate terms or reschedule payments if needed.

These types of loans typically have less favourable terms than multilateral loans, including higher interest rates, shorter grace periods, and more stringent conditions.

Bilateral lenders often impose conditions on the project tendering process, requiring borrowers to hire contractors from specific countries or companies. Multilateral lenders, on the other hand, typically allow for an open tendering system, giving borrowers more flexibility in choosing contractors.

Moreover, other conditions are imposed on the procurement of materials. For example, under the bilateral loan agreements with India, Bangladesh is required to purchase 75% of construction materials from India.

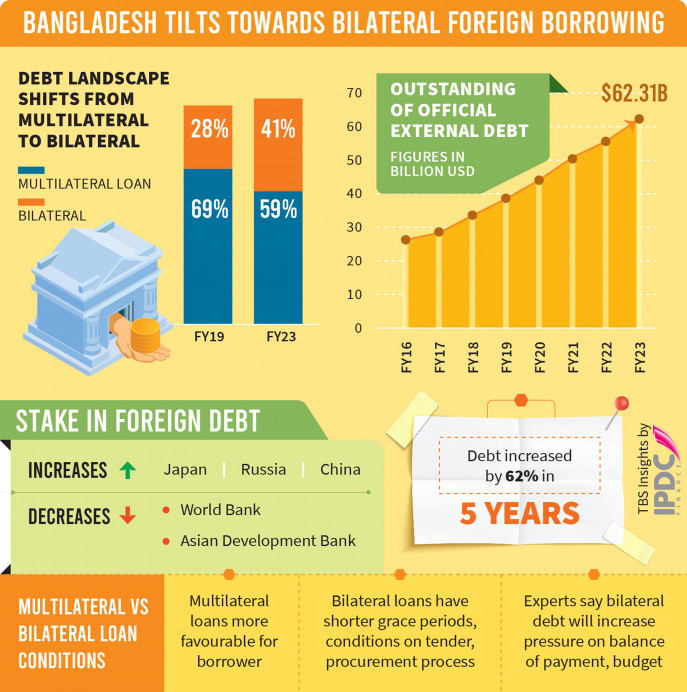

According to data from the Economic Relations Division (ERD), by the end of the fiscal year 2022-23, multilateral lenders’ share in Bangladesh’s foreign loans was 59%, which was 69% in the fiscal year 2018-19. During the period, the share of loans from bilateral sources grew from 28% to 41%.

Moreover, the overall outstanding foreign loans stood at $62.31b by FY23, posting a 62% rise in five years, data shows.

ERD officials said the outstanding foreign debt has increased because, in addition to foreign loans taken for several mega projects, the government has taken budget support from foreign sources due to the economic downturn caused by the pandemic and the Russia-Ukraine war.

As outstanding foreign loans continue to grow, there will be increased pressure to meet repayment obligations. In FY23, the government managed to repay $2.67 billion in foreign loans. However, it is anticipated that when the grace period for loans to ongoing mega projects concludes, the pressure for loan repayment will intensify, as suggested by the ERD.

According to ERD’s projection, debt repayments will increase to $3.56 billion in the current fiscal year, $4.21 billion in FY25 and $4.72 billion in FY26.

Most of Bangladesh’s total external debt since the country’s independence has come from major development aid agencies such as the World Bank and ADB. But the situation is changing now.

According to ERD data, foreign debt in the pipeline at the end of the 2022-23 fiscal year is $44.7 billion, which means the government has already entered into agreements with various development aid organisations for this amount.

Economists warn that this shift could increase the country’s borrowing costs and put more pressure on it to meet repayment obligations.

ERD data reveals that the World Bank’s share in the country’s foreign loans decreased to 31.34% in FY23, down from 32.60% in the preceding fiscal year. This drop occurred despite an increase in outstanding loans from the World Bank, rising from $18.12 billion to $19.53 billion during this period. Just two years ago, in the fiscal year 2020-21, the World Bank’s share in Bangladesh’s total outstanding foreign loans was 36%.

Like the World Bank, the Asian Development Bank’s (ADB) share in Bangladesh’s outstanding foreign loans has also seen a decline. At the end of the fiscal year 2021-22, the ADB’s share in the total outstanding loans was 23.88%, which decreased to 22.65% in FY23.

On the contrary, Japan’s share in the Bangladesh government’s total outstanding foreign loans had risen by 17.65%, Russia’s by 9.47%, and China’s by 8.62% by the end of FY23. Additionally, the Asian Infrastructure Investment Bank (AIIB), initiated by China in 2016, has contributed to a 2.4% increase in outstanding loans from China.

ERD data also shows that for the first time, the government’s outstanding foreign loan had surged to $62.31 billion by the end of FY23, up from $55.60 billion in the previous fiscal year. The outstanding foreign loans stood at $38.475 billion in the fiscal year five years ago.

A robust repayment plan is crucial

Experts emphasise the need to reevaluate, thoroughly analyse, and plan meticulously for the repayment of these loans, especially given the significant foreign funding involved in nearly completed mega projects such as the Rooppur Nuclear Power Project, the Metro Rail, the Padma Railway Link, the Karnaphuli Tunnel, the elevated expressway, and the third terminal at Hazrat Shahjalal International Airport.

Dr Zahid Hussain, the former lead economist of the World Bank’s Dhaka office, told The Business Standard, “The concern is that the share of flexible foreign loans is decreasing and the share of rigid loans is increasing. In the case of bilateral borrowing, the cost of finances [refers to the cost, interest, and other charges involved in the borrowing] will increase.”

“Multilateral development cooperation loans have long repayment periods, up to 30 years with a grace period of five to 10 years. However, most bilateral development cooperation loans have to be repaid fully in three to 15 years. As the bilateral debt increases, the repayment burden will increase,” he said.

“Besides, down payments have to be made against bilateral debts, which makes the debt more expensive. Therefore, if the bilateral debt increases, pressure on the country’s balance of payments [BOP] and the budget will increase,” the economist said.

Zahid Hussain also said everything is transparent when it comes to loans from multilateral development agencies, which is not the case for bilateral loans.

“In bilateral loan agreements, there are various conditions imposed on the purchase process. For instance, there are conditions for the hiring of contractors, for the purchase of project materials. Certain amounts of materials are to be purchased from the lending country,” he said.

Hence, bilateral rigid loans should be avoided as much as possible, even though these loans have geopolitical and other bilateral issues involved and multilateral loans should be increased, Zahid said.

At the G-20 conference, held in Delhi on 9-10 September, multilateral lenders announced to increase their lending. So, there is an opportunity to increase the loan share of multilateral organisations in the future, the former lead economist of the World Bank added.

Officials said the government has plans to implement more projects like developing the Dhaka-Chattagram highway from six to eight lanes at a cost of $6.6 billion and implementing the Dhaka Mass Rapid Transit (MRT-5) Southern Route project at a cost of $5.5 billion. Loans have already been received for these projects.

Review of foreign debt risk management

ERD officials said Bangladesh has been implementing many mega projects with foreign debt financing in recent years. There are plans to implement some other mega projects with foreign loans.

A decision has been taken to review the risk management of foreign debt considering the current outstanding foreign debt, foreign debt in the pipeline, size of GDP and economic situation.

As part of an ongoing ERD project, this review will be conducted over the next three months to analyse several issues including the amount of loan Bangladesh can take without increasing the risk, the kind of projects that will accelerate economic development or bring returns.

ERD officials said the government will undertake future development projects based on this review.

According to International Monetary Fund (IMF) norms, any country can borrow up to 40% of its GDP. At present the ratio of foreign debt in Bangladesh is less than 20%.