How project delays cost Bangladesh millions in penalty

Delays hinder loan disbursements, leading to higher commitment fees

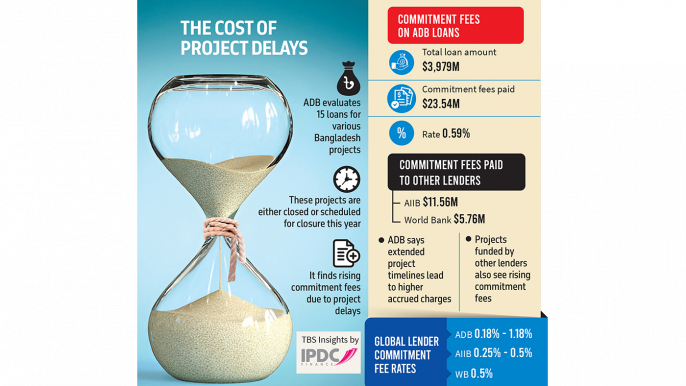

Rising financial penalties for prolonged delays in implementing foreign-funded development projects are costing Bangladesh millions of dollars in commitment fees paid to global lenders. Undisbursed amounts with lenders accumulate commitment fees over time.

A commitment fee is a fee that a borrower pays to the lender for keeping a line of credit open or guaranteeing a loan in the future.

For instance, the Asian Development Bank (ADB) approved $300 million in 2011 for the Power System Efficiency Improvement Project, which was scheduled for closing in 2017. But it was extended four times to December this year – originally a six-year project, now extending to 13 years.

The extension comes with a price: Bangladesh will have to pay $2.73 million or 0.94% of the loan size as a commitment charge, according to an ADB evaluation report, released early this October.

Moreover, the project delay has led to a 3% loan cost escalation due to factors including inflation and exchange rate fluctuations, reducing the net loan amount to $291.87 million, says the Manila-based lender.

Commitment fees of global lenders

Other global lenders also impose commitment fees on loans provided for development projects.

Commitment fees on loans from the Asian Development Bank (ADB) typically range from 0.18% to 1.18%, while the Asian Infrastructure Investment Bank (AIIB) charges between 0.25% and 0.5%. The World Bank (WB), on the other hand, generally applies a fee of 0.5%.

The commitment fee is calculated as a percentage of the unused portion and typically starts after a specified period, such as 60 to 90 days from the loan agreement. This charge compensates the lender for having the funds available for the borrower.

An ERD official, speaking anonymously, told TBS, “If development projects can be completed on time, no extra commitment fees would be required. However, in Bangladesh, delays are a perennial issue, with five-year projects often taking 10 years to complete.”

This delay is the primary reason for additional commitment fees, largely due to the inefficiency of the implementing agency or project manager, he said.

$23.54m in fees paid to ADB

The ADB analysed 15 Ordinary Capital Resources (OCR) loans extended to Bangladesh. OCR loans are provided to support development projects in low- and middle-income countries. Commitment fees are applied starting 60 days after loan signing.

The analysis of these project loans, closed or set to close by 2024, reveals that Bangladesh paid $23.54 million in commitment fees, which accounts for 0.59% of the total loan amount of $3.979 million.

Among the loan projects, commitment charges ranged from 0.18% to 1.18% of the net loan amount, according to an analysis of how Bangladesh is paying for delayed loan effectiveness, slow disbursements, and extended implementation periods, the report says.

High commitment charges were mainly due to long implementation periods and low early-stage disbursements. Additionally, many projects became effective more than 60 days after loan signing, which contributed to the accumulation of higher commitment fees.

The report highlights another project — the Akhaura-Laksam Double Track Project — under the Sub-regional Economic Cooperation Railway Connectivity initiative, which also incurred high commitment fees due to late loan effectiveness and slow disbursements. Of the $274 million net loan amount, $3.24 million, or 1.18%, was accrued as a commitment fee.

In contrast, for the $210 million Chittagong-Cox’s Bazar Railway Project Phase 1 under South Asia Subregional Economic Cooperation (SASEC), the commitment charge was $0.37 million, or 0.18% of the loan size — the lowest among all projects, thanks to improved loan effectiveness and implementation progress.

The loan achieved 92.9% of contract awards and 37% of disbursements within the same year, highlighting how good preparation and high project readiness contributed to the minimal commitment charge.

How project delays impact costs

The ADB report identifies several projects where extended implementation periods led to price escalations. For example, in 2012, the ADB approved $160 million for the Greater Dhaka Sustainable Urban Transport Project, which was scheduled to close in 2017.

However, the project was extended by five years, and the total cost surged by 94% to $494 million by 2022, requiring the ADB to increase its contribution to $260 million to cover the cost overrun.

The ADB report cites multiple contributing factors for the time and cost overruns, including underestimated costs for civil works, changes in project scope and design during implementation, delays in land acquisition and utilities shifting, slow mobilisation, contractor issues, and the impact of Covid-19.

Another project, the Dhaka Environmentally Sustainable Water Supply, approved for $250 million in 2013, also faced delays.

Its closing date was pushed from 2020 to June 2023, leading to a 24% increase in the contract price of Package 1, which was initially set for completion by May 2022.

However, completion is now expected by August 2025, with an additional $39.7 million, bringing the original contract value up by 36.7%.

Delays in land acquisition and resettlement, originally scheduled for completion by the fourth quarter of 2013, were delayed by more than three years, which in turn delayed civil works by 3 to 3.5 years.

$11.56m in fees paid to AIIB; $5.76m to WB

The Asian Infrastructure Investment Bank (AIIB) began its investment in Bangladesh’s power sector with a $165 million project in 2016. Over the first three years, AIIB financing totalled $445 million across four projects. As of now, the bank has funded 23 projects amounting to $3.85 billion.

Of these, 11 projects, worth $2.05 billion, have been completed, while 11 ongoing projects account for $1.76 billion. AIIB’s commitment fee rates range from 0.25% to 0.50%, with Bangladesh having paid $11.56 million so far.

Bangladesh is required to pay commitment fees for the World Bank’s Scale-up Facility (SUF) loan, which it first obtained in the 2017-18 fiscal year.

To date, Bangladesh has signed nine SUF loan agreements with the World Bank, totalling $2.39 billion. As of now, Bangladesh has paid $5.76 million in commitment fees for these loans.