Liquidity crunch widens fault lines in banking system

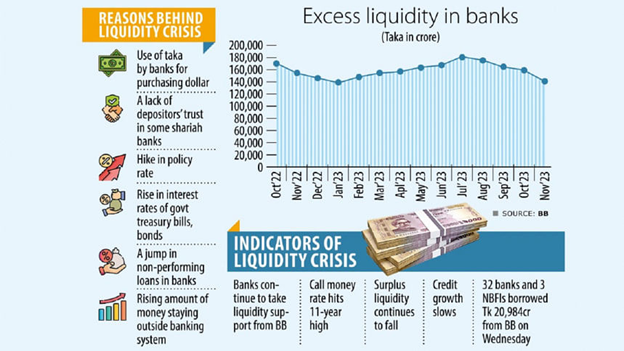

A majority of banks in Bangladesh are depending on the call money market and central bank to fund their activities due to an intensifying liquidity crisis in the banking sector.

Even hikes in the interest rate associated with Bangladesh Bank’s repo and liquidity support facilities have not deterred the banks from increasing their borrowing, industry people said.

On Wednesday, 32 banks and three non-bank financial institutions (NBFIs) took Tk 20,984 crore under a seven-day tenure repo facility, 14-day Islamic bank liquidity facility and one-day liquidity support facility.

A day earlier, 27 banks and one NBFI borrowed another Tk 13,422 crore from the central bank. At the same time, the call money rate hit an 11-year-high.

Call money is any minimum short-term loan repayable on demand with a maturity period of one to 14 days that is used for interbank transactions.

The average overnight call money rate stood at 9.24 percent on Wednesday while it was 6.37 percent on the same day in July last year.

Industry insiders said the call money rate generally increases when banks face a liquidity crisis and then borrow funds from the market.

The crisis in the forex market, slow deposit growth, lack of trust in some shariah-based banks, higher amount of bad loans and slow loan recovery are the main reasons for the liquidity crisis.

However, the liquidity crisis deepened when the central bank recently raised the policy rate to tackle ongoing inflationary pressure in the country, they added.

The call money rate started rising fast after the banking regulator increased the policy rate by 75 basis points to 7.25 percent in October.

Then in November, Bangladesh Bank again hiked the policy rate, also known as repo rate, by 50 basis points to 7.75 percent in an effort to rein in skyrocketing inflation.

Point to point inflation stood at 9.49 percent that month, which was way above the government’s target of 6 percent for the current fiscal year.

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank, said it has become very difficult to mobilise funds as the interest rates of government treasury bills and bonds recently rose.

Clients are withdrawing their funds from banks and investing them in government treasury bills and bonds as those offer 2 percent higher interest than the rate on deposits, he added.

In an auction on Thursday, the government raised Tk 6,183 crore through 91-day, 182-day and 364-day tenure treasury bills with interest rates of 11.15 percent, 11.20 percent and 11.50 percent respectively.

Against this backdrop, Rahman said the government has become a competitor in terms of collecting deposits, which is why the banking sector is now suffering an extreme liquidity shortage.

Echoing the same, a chief executive of a private commercial bank seeking anonymity told The Daily Star they are facing huge challenges due to the liquidity crunch.

He said the government was also facing a cash crisis that prompted it to hike the interest on treasury bills and bonds in order to collect funds.

At the same time, the volume of currency outside banks has increased amid uncertainty centring the national election to be held on Sunday.

Currency outside banks stood at about Tk 2.46 lakh crore in October 2023, up from Tk 2.36 lakh crore the same month the year prior, shows the latest data of Bangladesh Bank.

He also said the liquidity crisis has adversely impacted overall cash flow in the banking sector, which has been facing a forex crisis for the past 18 months, slow deposit growth and lacklustre loan recovery.

For the last two years, banks have been purchasing USD from the interbank platform and central bank by using local currency in face of a foreign currency shortage.

Bangladesh Bank sold $6.7 billion from the forex reserve to banks in the July-December period last year.

The central bank had also pumped more than $13 billion into banks in fiscal 2022-23 against the equivalent amount in local currency.

Five Islamic banks — Islami Bank Bangladesh, Social Islami Bank, First Security Islami Bank, Union Bank, and Global Islami Bank — are facing an extreme liquidity crisis due to loan irregularities.

In November last year, surplus liquidity in the banking sector stood at Tk 1.41 lakh crore, down from Tk 1.81 lakh crore in July.

Loan recovery is not in good shape as borrowers are using the current economic slowdown as an excuse for not paying back their funds, Mirza Elias Uddin Ahmed, managing director of Jamuna Bank, had told The Daily Star recently.

“This tightened the liquidity situation in banks,” he added.