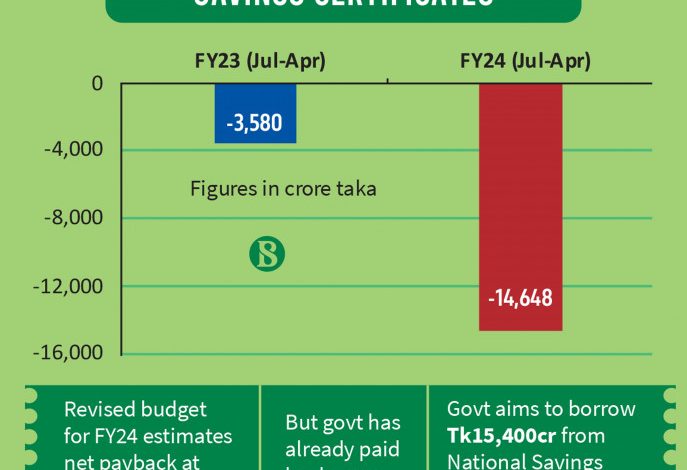

Net sales of national savings certificates plunge to negative Tk14,648cr in Jul-Apr

Experts say tighter regulations, inflation discourage people to invest in the scheme

The net sales of national savings certificates plummeted to negative Tk14,648 crore in the first 10 months of the current fiscal year 2023-24, according to Bangladesh Bank data.

Experts say the sales dropped as customers are now showing less interest in the scheme due to various restrictions imposed by the government.

The net sales of national savings certificates in the first 10 months of FY23 were negative Tk3,579 crore.

According to officials from the Department of National Savings and some bankers, various restrictions on investing in savings certificates have led to a decrease in customer interest in this scheme. Additionally, the interest rates on investments are declining, they say.

Middle-income individuals, who used to invest more in the sector, have reduced their investments due to persisting inflation over the past year and a half, they further said.

The government’s borrowing target from savings certificates for FY24 was Tk18,000 crore. However, in the revised budget, the government revised down the target to negative Tk7,310 crore.

However, the government has set a target to borrow a net amount of Tk15,000 crore from the sector to cover the deficit in the FY25 budget.

As of the end of April 2024, the total outstanding amount in savings certificates decreased to Tk3.52 lakh crore. At the beginning of the FY24, the amount was Tk3.60 lakh crore.

Department of National Savings Assistant Director and Public Relations Officer Masudur Rahman told TBS the reduction in savings certificate loans is due to the government lowering the borrowing target for this fiscal year, which has resulted in fewer loans being issued.

During the period, those whose investments have matured have been refunded their principal along with interest, he said.

He further mentioned that there are several other reasons contributing to the further decrease in investments in savings certificates. “The interest rates on bank deposits have increased significantly, and additionally, customers can now directly invest in treasury bills and bonds.”

Another official of the Department of National Savings on condition of anonymity told, “Customers are now unable to invest their entire pension in savings certificates as they could previously. Additionally, there used to be anonymous investments. Now, all investments require a TIN (Tax Identification Number) certificate, which has led to a significant decrease in investment.”

Many customers who previously invested in savings certificates have not reinvested after their maturity as a compulsory requirement of National ID, TIN, and submission of returns for investments exceeding Tk5 lakh, was introduced with effect from July 2019, he said.

Besides, an increase in tax deduction at source and reduction in interest rates on savings certificates and high inflation and increased interest rates on bank deposits contributed to their reluctance in the scheme, said the official.

The International Monetary Fund (IMF) has set a condition within its $4.7 billion loan agreement that requires the government to limit the sale of savings certificates to one-fourth of the total domestic borrowing by December 2026.