New monetary policy aims to rein in inflation, stabilise exchange rates

However, the central bank has not provided a specific timeline for this new mechanism to come into effect

Pressed by a liquidity crunch and soaring money rates, the Bangladesh Bank doubled down on tightening money supply, launching a new monetary policy to subdue the still-elevated inflation which has shown a slowing trend since November last year.

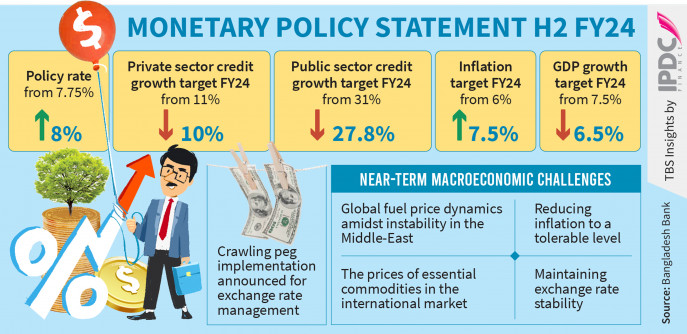

In its new monetary policy announced on Wednesday for the second half of the current fiscal year, the central bank increased the key policy rate, also known as the repo rate, by 25 basis points to 8%, effectively making money more expensive for banks.

The central bank has revised downward all money supply targets. Notably, the private sector credit growth target has been reduced to 10% for June, down from the previous 11%. Also, the broad money supply has been trimmed to 9.7% from the earlier target of 10%.

At the same time, the central bank has disclosed its intention to implement a “crawling peg” system to stabilise the exchange rate and prevent further depletion of the country’s foreign exchange reserves. This new mechanism will be linked to the real effective exchange rate, measured against the currency basket of trading partner countries and will operate within a predefined exchange rate corridor.

However, the central bank has not provided a specific timeline for this new mechanism to come into effect.

This tightening of monetary policy occurs at a time when private sector credit growth remains sluggish, hovering around the single-digit mark, posing challenges to the attainment of the government’s growth target of 6.5%.

The Bangladesh Bank is determined to persist with its stringent monetary policy until the point-to-point inflation recedes to the 6% level, with less emphasis placed on fostering economic growth.

“We do not have any headache about growth, inflation is our main target,” said Bangladesh Bank Governor Abdur Rouf Talukder while unveiling the new policy.

Acknowledging the liquidity crisis in banks and recognising that additional tightening might adversely impact investment, he mentioned that a 1% decline in growth would not pose a significant problem. Hence, contractionary monetary policy will continue until inflation comes down to a 6% level.

Meanwhile, the Bangladesh Bank will provide various low-cost credit schemes to support employment. Loans for small businesses will be given at 4% to 5% rates under credit schemes when the market rate is above 12%, the governor said.

He said the dollar shortage is the main reason behind the liquidity crisis. The Bangladesh Bank sold $28.7 billion to banks in the last three years through which Tk2.84 lakh crore was mopped up. But the same amount of money was not injected in the market which created a liquidity crisis.

Moreover, the Bangladesh Bank has stopped money creation for government financing since August last year. As a result, the government has been borrowing from the banking system creating liquidity pressure, said the governor.

Abdur Rouf said not only Islamic banks but conventional banks are borrowing Tk30,000 crore to Tk 35,000 crore from the Bangladesh Bank daily due to the liquidity crunch.

He said the impact of existing contractionary monetary policy was not very visible as it takes time to transmit the monetary policy impact into the real economy. However, the rising trend of inflation has stopped and it started to drop in November last.

Bangladesh Bank data shows that point-to-point inflation slightly declined to 9.41% in December from 9.49% in November. However, monthly average inflation increased to 9.48% from 9.42% during the same period.

In the new monetary policy, the Bangladesh Bank projected to bring down inflation to 7.5% by June in line with the government’s target when GDP growth was projected to be 6.5%.

Dr Zahid Hussain, the former lead economist of the World Bank’s Dhaka office, told that the policy rate hike is not enough to contain inflation. The central bank needs to go for a bigger hike to get immediate results.

Echoing the same, Ahsan H Mansur, the executive director of the Policy Research Institute of Bangladesh, said the central bank should be more aggressive in hiking the policy rate.

He, however, welcomed the upcoming new exchange rate mechanism saying that if it is maintained with a real effective exchange rate, it will work well.

Nurul Amin, former managing director of Meghna Bank, told that the announced monetary policy is well-timed to contain inflation.

However, there will be a collective impact in the short term, as the increase in the policy rate will elevate borrowing costs for all.

Furthermore, he added that the reduction in private-sector credit growth will adversely impact inflation.

Measures for stabilising forex market

The central bank governor said a free-float exchange rate mechanism is usually implemented based on demand and supply, which is not possible considering economic fundamentals.

In this perspective, the Bangladesh Bank is going to implement a new crawling peg system in which the exchange rate will be set based on a real effective exchange rate measured with 15 trading partners.

He said the dollar rate will fluctuate based on real economic exchange rates and economic fundamentals. As a result, the central bank will not need to provide dollar support much in the market and dollar inflow will increase after implementing the new crawling peg system.

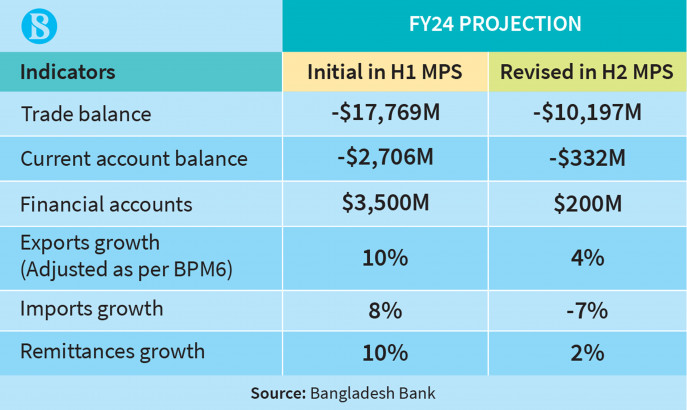

Explaining the financial account deficit, the governor said the Bangladesh Bank paid off external liabilities of $18 billion in the last one and half years which put pressure on the forex reserves.

He said the majority portion of the liabilities were paid off, and the monthly external loan payments will come down to $100-$200 million soon. As a result, the reserve will rebound in the coming days.

Governor Abdur Rouf Talukder said the current account balance turned into a surplus thanks to controlled imports. Though controlled imports caused suffering for many businesses, the central bank had no other option.

He questioned if the annual import of $90 billion after the Covid year was really appropriate. “If the same trend was allowed, imports would have crossed $120 billion. Then where would our reserves stand now? So, all of us have to take the hit of controlled imports,” he said.

He said there is no alternative than to increase dollar inflow. Banks are encouraged to increase their credit line with foreign lenders to improve their dollar liquidity.

Review of existing monetary policy

Dr Md Habibur Rahman, the chief economist of the Bangladesh Bank, gave a presentation on the impact of existing monetary policy saying that it helped to make the money market tight according to the expectations.

He said the global central banks increased their policy rates aggressively and the Bangladesh Bank followed suit a little late. The contractionary monetary policy started to yield results as all monetary rates turned upward due to the tight liquidity situation.

The chief economist said excess liquidity in the banking sector declined to Tk5,430 crore in November last year from Tk11,630 crore in June.

Islamic banks are mostly responsible for depleting excess liquidity as their balance dropped to Tk183 crore in November from Tk2,871 crore in June last year, according to his presentation.

Call money rates rose to 8.84% in December from 6% in June and all deposit and lending rates also surged in the last six months, he said.

Habibur Rahman said the central bank will continue the tight monetary programme until inflation comes down to a 6% level.

Selim RF Hussain, chairman of the Association of Bankers Bangladesh, welcomed the new monetary policy stance, citing its continuity from the previous approach.

Recognising inflation as the primary challenge, he commended the central bank’s decision to curtail the money supply in the market by raising the interest rate.

Selim, also the managing director of BRAC Bank, further endorsed the introduction of a crawling peg to adeptly manage the exchange rate. “The exchange rate would be fixed after consultations with Bangladesh’s top 15 trading partners. This system will contribute to stabilising the rate,” he added.