Pension Scheme fails to impress, savers prefer other options

Only 91 expats subscribed to UPS in last three months

The Universal Pension Scheme is struggling to gain traction among Bangladeshis, particularly expatriates who are losing interest in the benefit system due to low interest rates, the absence of a one-time payment facility, and the declining value of taka against dollar.

The much-hyped scheme garnered a moderate 398 expatriate subscribers till 16 September, within its first month of launch.

However, momentum dwindled soon after with only 91 individuals enrolling in the public pension fund in the subsequent three months until December 19, according to the latest figures of the National Pension Authority.

After the launch, pension authorities anticipated a substantial number of expatriates joining the scheme to channel foreign exchange through legal channels.

As the expectation is yet to materialise, the pension authority officials said that after the upcoming national elections, steps will be taken to revitalise interest in the scheme among expatriates and local businesses.

These measures may involve reassessing the interest rate, conducting campaigns abroad through banks to encourage expatriates, and encouraging officers and employees of the country’s corporate houses to enrol in the scheme.

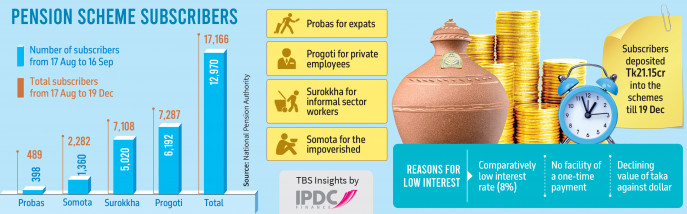

Launched on 17 August, the government introduced four pension schemes: “Probas” for expatriates, “Progoti” for private employees, “Surokkha” for informal sector workers, and “Somota” for the impoverished.

In the first month, 12,970 people joined these schemes, which increased to 17,166 in the subsequent three months. As of December 19, subscribers have deposited a total of Tk21.15 crore into the schemes.

Interest rate of scheme is lower than bank offering

A finance division official explained the waning interest, pointing out that the schemes’ fixed interest rate of 8% is lower than what several private banks are offering.

Moreover, investing in other saving instruments provides an opportunity to recover the principal amount along with attractive interest rates.

There is also a concern whether private sector and informal sector workers will have sufficient income to meet instalment payments until age 60.

“The interest rate of pension schemes is flexible. The authorities will reschedule it from time to time after reviewing the situation. There may be some changes in this regard after the elections,” stated the official.

Additionally, the National Pension Authority has collaborated with the mobile financial company Nagad, enabling convenient instalment deposits through the mobile financial service.

Dr Sayema Haque Bidisha, professor, Department of Economics, University of Dhaka, said the schemes need to be financially appealing.

“To encourage expatriates, there needs to be an understanding that investing in public pensions is more profitable than other options, and the scheme should be designed accordingly,” she added.

The pension fund could benefit from a review based on similar schemes in other countries, said the economist.

Efforts to lure more expats

To boost expatriate participation in the universal pension system, the Ministry of Finance held a meeting with the managing directors of state-owned and private banks on 15 November.

At the meeting, Finance Division Secretary Khairuzzaman Mozumder expressed concern about the sluggish registration pace in the pension scheme, particularly highlighting the limited subscription to the Probas scheme.

Kabirul Ezdani Khan, chairman of the National Pension Authority, suggested making it easier for expatriates to join and register, and changes to the online system have been suggested.

Bank directors have been asked to quickly improve IT infrastructure, addressing issues in collecting pension instalments, he told the meeting.

Besides, banks need to coordinate with exchange houses and fintech companies abroad to remove all obstacles related to pension schemes.

Banks have also been urged to promote the advantages of the universal pension scheme both domestically and internationally.

Involving corporate houses

During the meeting, the finance ministry requested banks and corporate houses to collaborate in attracting subscribers from various categories.

Since the salaries and allowances of corporate house officers and employees are processed through banks, the finance division urged bank CEOs to conduct campaigns and motivational activities to encourage employees of the corporate houses in the Progoti scheme.

Bankers pledge to do more

Md Afzal Karim, managing director and CEO of state-owned Sonali Bank, said his bank possesses its own payment gateway and e-wallet, which will be leveraged to attract subscribers.

He added that Sonali Bank has agents in various countries, and they can use these agents to increase participation in the Probash scheme.

City Bank Managing Director Mashrur Arefin suggested making all bank branches accessible for universal pension schemes.

He said new customers could be encouraged to subscribe to the universal pension fund during the account opening process.

Md Mazibur Rahman, the managing director of state-owned Probashi Kallyan Bank, said his bank offers three days of training to individuals heading abroad.

“During this training period, they will be encouraged to join the Progoti scheme,” he added.

Besides, employees going abroad with loans from the bank can be registered in Progoti at the time of loan disbursement, Mazibur proposed.