S Alam group, Associates: Tk 95,000cr loans taken from 6 banks

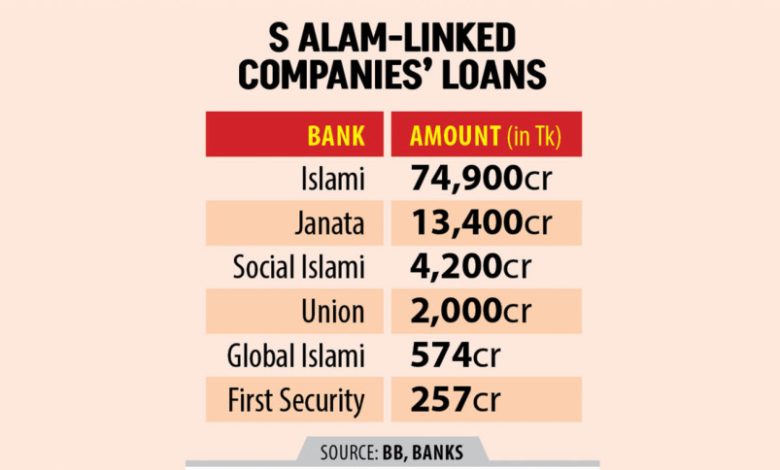

S Alam Group and its associate companies took out Tk 95,331 crore between 2017 and June this year from six banks, with 79 percent of the sum coming from Islami Bank.

This amount is equivalent to 5.78 percent of the banking sector’s total outstanding loans as of March.

However, the total amount taken from these six banks is likely higher, according to Bangladesh Bank and bank officials with knowledge of the matter.

Documents pieced together by The Daily Star show that most of the loans were taken by bypassing banking rules and regulations, which is a testament to how the Chattogram-based conglomerate exerted its influence on the country’s banking sector.

Founded in 1985 by Mohammad Saiful Alam, a relative of former Awami League politician Akhtaruzzanan Chowdhury Babu and former Land Minister Saifuzzaman Chowdhury, S Alam Group has grown into one of the largest conglomerates in Bangladesh.

For example, within one month of opening an account with Islami Bank’s Chaktai branch in Chattogram, a modest corrugated tin seller Murad Enterprise was given Tk 890 crore without even verifying the need for the funds and the company’s financial capacity to pay back the sum.

A year later, another loan of Tk 110 crore was given to the company, which turned out to be a shadow company of S Alam Group, BB documents show.

What is worse is that the bank, where S Alam Group has controlling stakes, took very little collateral from Murad Enterprise.

The conglomerate and companies with ties to it took Tk 74,900 crore from Islami Bank, whose chairman since June last year is Alam’s eldest son Ahsanul Alam.

Of the amount, Tk 26,000 crore was borrowed in the name of its subsidiaries, and the remaining amount was in the name of 29 associate companies, such as Nabil Group, Desh Bandhu Group, Unitex Group, and Anantex Group.

Islami Bank’s Khatunganj branch in Chattogram is particularly noteworthy: a staggering Tk 35,924 crore was taken from the branch through 10 companies, documents show.

S Alam Group and its shadow companies, such as Nabil Foods, Nabil Auto Rice Mills, MS AJ Trade International, and Anowara Trade International, secured loans amounting to Tk 29,575 crore from the Rajshahi branch of Islami Bank.

Another Tk 23,900 crore was taken from Islami’s offshore banking unit and other branches over the years in violation of rules.

Rules were also not followed by state-run Janata when extending loans to the business giant, whose interests range from commodity trading to fishery, from construction materials to real estate, from textiles to media, from intercity buses to shipping, and from power and energy to banks and insurance.

S Alam Group and its affiliate companies took Tk 13,400 crore from state-run Janata Bank.

About Tk 10,449.45 crore was taken in the name of S Alam subsidiaries, with as much as 90 percent of the loans taken from Janata’s Sadharan Bima Corporate Branch in Chattogram.

The remaining Tk 2,950.55 crore was taken from Janata by its associate companies.

Janata’s lending to S Alam Group breached the bank’s single borrower exposure limit by an alarming margin.

According to banking law, a bank is prohibited from lending more than 25 percent of its paid-up capital to a single party. At the end of June this year, Janata’s paid-up capital stood at Tk 2,314 crore.

Some Tk 4,200 crore was taken from Social Islami Bank (SIBL), whose chairman Belal Ahmed is Alam’s son-in-law. Five more relatives of Alam are on the board of SIBL.

Some Tk 2,000 crore was taken from Union Bank, whose board consists of Alam’s siblings Halima Begum, Osman Goni, and Md Rashedul Alam and his wife Marzina Sharmin. Their nephew, Mohammad Mostan Billah Adil, is also on the board.

S Alam Group and its associate companies took Tk 574 crore from Global Islami Bank (GIB), whose vice-chairman is Alam’s daughter Maimuna Khanam. Seven other relatives of Alam, including his brother Shahidul Alam and sister Rokea Yasmin, are on the board of the 11-year-old bank.

Some Tk 257 crore was taken from First Security Islami Bank (FSIBL), whose chairman is Alam himself. Alam’s wife, Farzana Parveen, and four other relatives are on the board of FSIBL.

If the loans taken by its associate companies are added, the total amounts taken from SIBL, FSIBL, Union, and GIB will go up, according to industry insiders.

In light of the gross irregularities, the BB yesterday restricted the lending activities of the banks save for Janata.

Alam; Subrata Kumar Bhowmik, executive director of S Alam Group; the managing directors of the six banks; and BB spokesman Md Mezbaul Haque could not be reached for comment.