Taka appreciated officially, market reacts quite opposite

The central bank’s latest calculation shows gross reserves at $25.16 billion

The Bangladesh Bank has sold $5.23 billion from its reserves to commercial banks in just four and a half months of the current fiscal year amid a severe dollar crisis.

This has resulted in a depletion of $4 billion of foreign exchange reserves between July and mid-November, a stark indication of the strong demand for the greenback and the pressure on the exchange rate to further depreciate.

Meanwhile, the country’s forex reserves kept falling, standing at $19.52 billion on 23 November, according to the central bank’s latest data.

Amid this situation, the taka was appreciated by Tk0.50 per dollar, endorsing the rates revised by two bankers’ associations. This counter-intuitive decision went against the tide of depreciation pressure.

On 22 November, the Association of Bankers, Bangladesh (ABB) and Bangladesh Foreign Exchange Dealers Association (Bafeda) announced a reduction in the rate of dollar for both remittance and export proceeds to Tk110 from Tk110.50, breaking over a year of rising streak.

The dollar price for importers has been set at Tk110.50, down from Tk111. A day after the new rates were announced, the central bank came up with an explanation defending the taka appreciation with its spokesperson Mezbaul Haque stating that the demand for foreign currency has dropped due to declines in foreign debt and imports.

He also projected that the dollar price will fall further as the payment burden for foreign debt has been declining fast.

However, the immediate market reaction is completely opposite with the remittance dollar selling at nearly Tk20 higher than the set rate in the kerb market.

Just a day after the new rates were announced, the remittance dollar price jumped to Tk121-Tk122 from Tk118-Tk119.

When asked when a country should raise the value of its currency, Zahid Hussain, the former lead economist of the World Bank’s Dhaka office, told The Business Standard that countries like Bangladesh, with fixed exchange rates, typically consider forex reserve stability, and dollar liquidity, before appreciating local currency. However, Bangladesh’s depleting reserves and dollar scarcity rule out taka appreciation.

He said the central bank might have taken such a decision to break the trend of continuous devaluation of the taka.

“The steady appreciation of the dollar has fueled expectations of further price increases, prompting individuals to stockpile dollars to maximise profits. To curb this trend and dispel notions of an unending dollar rally, the central bank has implemented a devaluation strategy,” the economist presumed.

However, the day after the dollar price reduction, remittance dollar prices rebounded promptly, indicating that the dollar’s allure remains strong. Amid a dollar shortage, such devaluation tactics may have minimal impact on market dynamics, Zahid Hussain said.

While acknowledging improvements in certain foreign exchange indicators, former IMF economist Ahsan H Mansur cautioned that the current dollar crisis in the market necessitates a cautious approach to taka revaluation.

He said the central bank’s decision to reduce the dollar price through Bafeda signals its commitment to stabilising the exchange rate but should not be interpreted as a sign of impending taka appreciation.

“Undoubtedly, the decision carries more political undertones than purely economic considerations. The central bank’s primary objective is to prevent a surge in dollar prices prior to the upcoming elections,” Mansur added.

Asked about the rationale for appreciating the taka in this situation, a senior executive of the Bangladesh Bank said they want to give a signal of macroeconomic stability ahead of the general election.

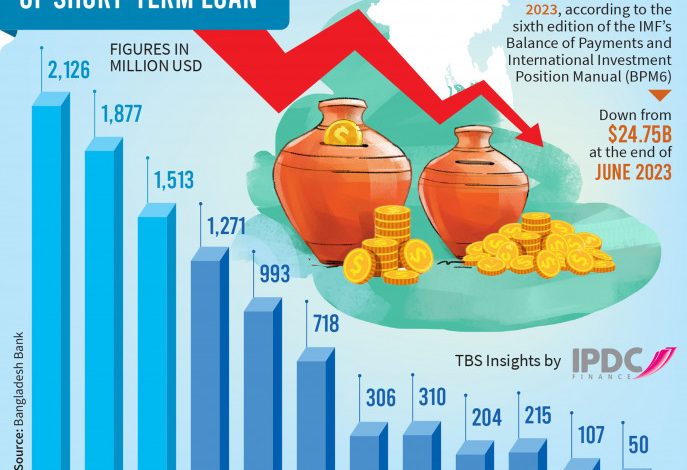

The central bank spokesperson, while explaining how demand for the dollar will ease in the near future, cited the decline in short-term foreign debt taken mostly by the private sector.

Mezbaul Haque said the monthly repayment against short-term debt will come down to only $49.87 million in September next year when Bangladesh had to pay back above $2 billion in October this year.

According to central bank data, the nation repaid more short-term foreign loans than it borrowed in the first eight months of this year. Short-term external debt now stands at $12.4 billion.

Economist Ahsan H Mansur said the Bangladesh Bank calculated only the repayment schedule without mentioning the foreign currency sources to make repayments.

Bangladesh will need to have inflows of $14 billion to $16 billion to turn the financial account into surplus to be able to pay back net $12 billion in short-term loans.

However, the inflow of short-term loans has been declining due to problems on both the demand and supply sides, he pointed out.

He explained that as short-term loans fell, repayments were being made from reserves as the financial account was negative.

Reserves now $19.52b

According to a report of the central bank, the country’s reserve amount on 23 November stood at $19.52 billion based on the Balance of Payments and International Investment Position Manual (BPM6). The amount calculated as per BMP6 is entirely usable.

The central bank’s latest calculation shows gross reserves at $25.16 billion.

The IMF introduced the BPM6 manual in 2012, which requires the central bank to exclude $3.5 billion from the Export Development Fund (EDF), $160 million from the Green Transformation Fund (GTF), $270 million from the Long-term Financing Facility (LTFF), $860 million of Sonali Bank Financing Facility (SBFF), $450 million deposits with ITFC, $390 million in Rooppur-escrow account. With these amounts deducted, the gross reserves in the BPM6 count stand at $19.52 billion.

Bangladesh’s gross reserves rose to $48 billion in August 2021 due to a massive increase in remittances and a fall in imports during the pandemic period.

Bankers and economic analysts said reserves are now diminishing due to the insufficient growth of remittances and export receipts in comparison to import expenditure.

The central bank is now expecting a boost in its forex reserves by December this year when the second tranche of the IMF’s $4.7 billion loan package is disbursed.