Beza aimed big, now loan repayment becomes a headache for it

Beza urges the government for infrastructure development in economic zones via relevant ministries

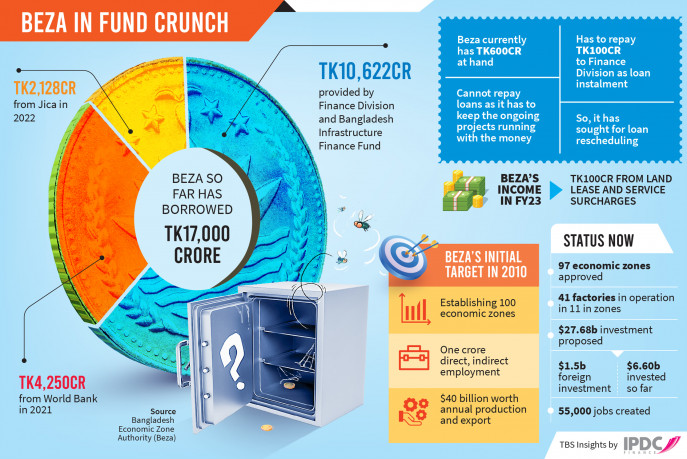

In its ambitious quest to establish 100 economic zones across the country, the Bangladesh Economic Zones Authority (Beza), forged in 2010, finds itself burdened with a staggering Tk17,000 crore in loans.

While 11 of its economic zones are running, eight being operated by private sector enterprises, Beza pleaded for a lifeline to the finance ministry in November last year, asking for loan rescheduling facility as it does not have sufficient income to pay back the loans it took over the years.

Compounding Beza’s fiscal woes is the reluctance of investors to set up industries in Bangabandhu Sheikh Mujib Shilpa Nagar in Mirsarai, the largest among the planned 100 zones encompassing a vast 30,000 acre campus.

This setback has disrupted Beza’s plans to generate income and pay off the loans it took to develop infrastructure.

Sheikh Yusuf Harun, executive chairman of Beza, told that they are facing three challenges: getting enough funds, acquiring land, and dealing with companies that have taken land but haven’t invested in the allotted plots.

For instance, the BGMEA, an association of garment industry owners, has not yet utilised the 500 acres allocated to them in 2019 in Bangabandhu Sheikh Mujib Shilpa Nagar. Similarly, the SBG Group has not done anything with 550 acres of land it received in 2017.

Beza’s loans and spending

To develop the economic zones, the agency has borrowed Tk17,000 crore from the government and development partners, according to Beza officials.

Of this, a loan of Tk4,250 crore was taken from the World Bank for the establishment of Bangabandhu Sheikh Mujib Shilpa Nagar in 2021.

The next year, Tk2,128 crore was taken from the Japan International Cooperation Agency for the creation of the Japanese Economic Zone at Araihazar in Narayanganj.

Rest of the loan was provided by the Finance Division and the government financing agency Bangladesh Infrastructure Finance Fund Limited.

Adding to Beza’s predicament is a recent and substantial spike in loan costs that surged from 1% to 6%, as disclosed in a Beza document.

Beza’s income

Beza officials said the organisation has only two sources of income. Income against land lease, service charge, and surcharge on utility bills.

They said the income is inadequate compared to expenditure. As the industrial plants are not in full operation, the income is low as opposed to services.

In FY23, Beza earned around Tk100 crore. It provides 125 services to investors operating in economic zones.

Missed loan instalment

Sheikh Yusuf Harun, executive chairman of Beza, told The Business Standard that they had missed an instalment of a loan from the Finance Division in 2015.

“Other local loans are being paid regularly. Besides, the government is the guarantor of foreign loans. These loans will be paid by the government,” he added.

Sheikh Yusuf did not disclose the amount payable to the division.

Another senior Beza official, however, told that the instalment amount is around Tk100 crore up to June 2023.

The official said Beza currently has about Tk600 crore at hand. However, this money cannot be used for loan servicing as the organisation is currently involved in several development projects to be funded with the money.

How Beza plans to pay off debt

A senior Beza official said they have prepared a review on how to clear the organisation’s debts and a report of the review will be sent to the prime minister.

The report proposed considering the cost of Beza activities as government grants.

Additionally, it has suggested financing through low-interest loans where grants are not available.

The proposal also includes the implementation of projects such as building fire stations, connecting roads, railway lines, and utility lines in economic zones through relevant ministries.

Meanwhile, a Finance Division official said they were reviewing Beza’s proposals. Besides, the division has advised Beza to increase service charges to boost income.

The official added that in the future, Beza’s projects could be financed through a combination of partial grants and partial loans.

Model zones suggested

Khondaker Golam Moazzem, research director at the Center for Policy Dialogue (CPD), told that there is enough justification for borrowing. But the question is how the feasibility of taking the loan was verified.

He said Beza expected investments in economic zones to generate income for loan repayment. However, with the zones facing challenges in desired investments, there is currently no income.

Moazzem suggested establishing one or two economic zones as models to swiftly provide comprehensive services, attracting investors, and addressing the challenges of recovering bad investments.

Initial goals vs current reality

Beza’s initial aim was to create jobs for one crore people and produce and export goods worth $40 billion every year.

However, Beza has so far approved 97 economic zones in public-private partnerships. Of these, commercial production has started in 41 industrial plants in 11 economic zones. Around 55,000 people are employed in these factories.

Infrastructure development is underway for an additional 50 industrial plants. Additionally, development work is ongoing at 29 more economic zones.

The agency has acquired 62,000 acres of land for developing economic zones.

So far, 6,607 acres of land has been leased to 197 investors. A total investment of $27.68 billion has been proposed, including $1.5 billion as foreign direct investment.

Countries that have made significant investments in economic zones include Japan, China, India, Australia, the Netherlands, Germany, the US, the UK, Singapore, South Korea, and Norway.

Among the major brands that have invested are Asian Paints, Berger Paints, Jotun Paint, Adani Ports and SEZ, Sumitomo Corporation, CCECC, Zei Hong, Yabang Group, Marico, Nippon Steel, Honda Motors, Miago, Huntsman, Sigwork, and Sakat Inc.

In addition to establishing economic zones, Beza has established three (Sonadia, Sabrang and Naf) tourism parks in Maheshkhali and Teknaf. Twenty-one companies have already been allotted land in Sabrang Tourism Park.