Dollar elusive at money changers, price jumps to Tk125 in kerb market

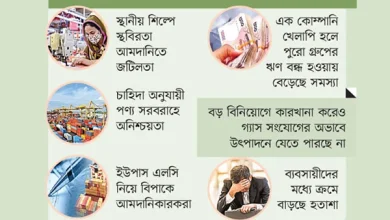

Several money changers in the Paltan area reported a complete lack of dollars available at the official rate of Tk119

Amid the instability over quota reform protests, the dollar rate in the open market surged by Tk6 to reach Tk125.

Dollar trading remained low at several money changers in Dhaka today (1 August), including those in Gulshan and Motijheel.

This comes despite the Money Changers Association of Bangladesh (MCAB) issuing a directive yesterday to set a fixed dollar rate of Tk119. However, this rate was not followed in the market.

Nadir Hossain, a dollar seller, told that the dollar rate was Tk120 in the open market on 16 July.

He attributed the rising dollar price to a decline in remittance inflows due to ongoing unrest in the country since 16 July.

The dollar continued its upward trajectory last week. On 27 July, it was trading at Tk122, but by 30 July, the price climbed to Tk123.50. The surge continued, with the dollar reaching Tk124.50 on 31 July, before peaking at Tk125 today.

Ripon Hossain, a dollar seller in the Motijheel area, told that dollar supply is declining, leading to the price surge.

He confirmed selling dollars at a maximum of Tk125 yesterday.

“A customer requested a larger amount of dollars. I told him to purchase at the prevailing market rate next Sunday due to anticipated price increases,” he said.

Several money changers in the Paltan area reported a complete lack of dollars available at the official rate of Tk119. They revealed purchasing dollars from customers at rates exceeding Tk120.

When questioned about the situation, MS Zaman, president of the Money Changers Association of Bangladesh, said, “The association followed the central bank’s instructions. We have nothing to do about the price surge.”

He attributed the dollar shortage to a decline in remittance inflows, emphasising that money changers have no control over the supply.

Zaman also pointed out that selling dollars at the official rate of Tk119 would only be feasible if the Bangladesh Bank provided dollars at a rate of Tk118.

Inward remittance inflow has dropped to the lowest point in 10 months at $1.91 billion in July.

Year-on-year, the remittance inflow in the country fell by 3%. In July last year, remittance inflow stood at $1.97b.

Bankers said, remittance inflow witnessed a slight decline in July following Eid-ul-Adha.

However, the ongoing situation has exacerbated the issue, with rumours discouraging expatriates from sending remittances through official banking channels.