RMG expects order pickup from April based on US, UK market reports

Bangladeshi exporters anticipate a surge in clothing orders from the beginning of the second quarter of 2024, particularly as global retail shops have successfully cleared out their winter inventories, thanks to several festive occasions and easing inflation in the West

After a chilly winter for the apparel industry, a sunnier outlook may bloom in the coming summer.

Bangladeshi exporters anticipate a surge in clothing orders from the beginning of the second quarter of 2024, particularly as global retail shops have successfully cleared out their winter inventories, thanks to several festive occasions and easing inflation in the West.

In discussions with, Bangladesh’s apparel industry leaders and representatives of global buyers said retail outlets in their major export destinations such as the USA and the UK experienced a sales boost during November and December due to various festivals such as Black Friday, Cyber Monday, Christmas Day, and Boxing Day.

Data from the US Census Bureau also indicates a consistent upward trajectory in apparel store sales over the past year, increasing from $13.7 billion in monthly sales in January 2023 to $21.8 billion in November.

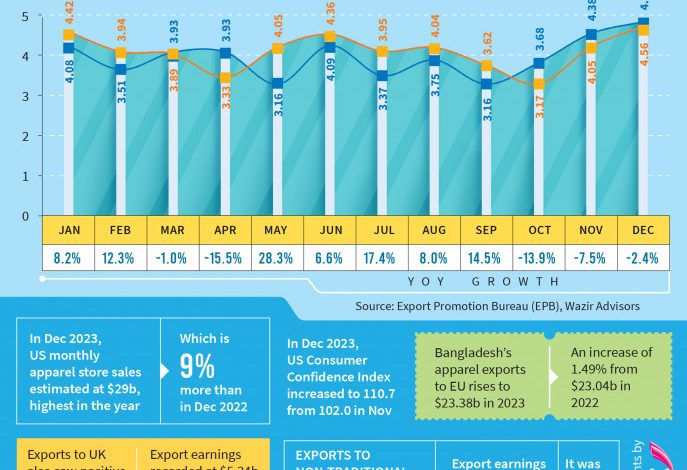

In December last year, US monthly apparel store sales were estimated to be $29 billion, 9% higher than in December 2022. On a year-to-date basis, the sales in 2023 were 6% higher than in 2022, according to Wazir Advisor, an Indian market research firm.

The Conference Board, a worldwide think tank, carries out a monthly assessment of US consumer sentiments, spending intentions, and outlooks regarding inflation, stock prices, and interest rates.

According to its latest survey, the US Consumer Confidence Index rose to 110.7 in December 2023, marking an increase from 102.0 in the preceding month. This figure is slightly above the index recorded in December 2022.

Retail clothing sales in the UK market went up as well.

According to data from the Office of National Statistics, the executive office of the UK Statistics Authority, monthly retail sales for apparel in the UK market exhibited an upward trend throughout 2023. However, the market also experienced a slight downturn in the last quarter.

In December last year, Bangladesh achieved its highest monthly apparel export value, totalling $4.56 billion over the 12 months of 2023. However, this figure represented a 2.4% decrease compared to December 2022, according to Export Promotion Bureau (EPB) data.

The overall growth in exports for the entire 2023 saw a slight 3.67% increase. The total export for 2023 amounted to $47.39 billion compared to the $45.71 billion recorded in 2022, EPB data shows.

Orders expected to surge from Q2

Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said, “Our exporters are expecting a surge in apparel orders from global buyers starting from the second quarter of this year.”

Referring to the drop in inflation in Europe and the US, he said, “Brands are expected to boost their apparel sourcing from Bangladesh, having successfully cleared their inventory over the past year. Some buyers are already in talks with our exporters to ramp up orders.”

Fazlee Shamim Ehsan, vice president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said countries belonging to the Organisation for Economic Co-operation and Development (OECD) are expected to witness a decline in inflation to 3.2%, along with projected GDP growth of 1.2% in 2024.

“We foresee a boost in Bangladesh’s apparel exports during the second quarter of 2024,” Shamim Ehsan said, adding that as inflation cools down, consumers are likely to spend more on clothing items.

Shofiqur Rahman, executive director (Sales and Marketing) of Zaber & Zubair Fabrics Ltd, the largest textile division of the Noman Group of Industries, also reflected the optimism expressed by leaders in the apparel industry.

“In the post-pandemic era, global brands engaged in extensive imports, with a substantial portion of the merchandise stored as inventory in their warehouses. Nevertheless, a majority of retail outlets have already exhausted their inventories, attributed to an early winter in Western countries last year,”.

Drawing on his personal experience during last year’s visit to Denmark, Shofiqur said typically, winter snowfall in the West occurs towards the end of December but snowfall occurred a month early this time which prompted retail stores to clear out their inventory.

“There is a potential for increased business opportunities. Some exporters are now in talks with buyers for order placements between May and June,” Shofiqur Rahman said.

The textile manufacturers plan to start fabric production in early June, with garment production expected to start later in June, continuing through November, the Zaber & Zubair official added.

Preferring to remain anonymous, a senior official from a European brand informed TBS that they were apprehensive of potential political instability in view of the national election in Bangladesh. With the election now over, they are now of a positive outlook.

The head of business development for another multinational buying house, who also oversees the South Korean market, predicted that the current year will be favourable for the apparel business citing the decline in inflation across various countries.

The import market in Korea remains stable compared to the previous year and Bangladeshi exporters are experiencing growth due to their competitiveness, the buying house official added.

Some challenges yet to be addressed

BGMEA President Faruque Hassan said despite a potentially bright outlook, the industry is poised to encounter numerous challenges in the coming days. The recent increment in minimum wage at factories starting from December last year, a surge in lending rates, and elevated gas and electricity prices, are causing substantial increase in production costs.

Shofiqur Rahman, the executive director of Zaber & Zubair Fabrics, said freight costs hiked due to the Red Sea conflict, and lead time went up. Now every factory has to extend their shipment time and it has become a challenge for all apparel exporting countries, not only Bangladesh.

But those countries having deep sea ports will get a competitive advantage. Freight costs also will increase raw materials import costs. At this moment, our customers expect prices below the actual product cost.

Currently, some industrial zones are facing winter time gas supply shortages, but the government is looking for long-term sourcing partners for LNG, which might be a solution for gas supply, Shofiqur Rahman said.

Textile makers are trying to continue their business at break-even cost and in some cases a little bit below that, he said.

He, however, mentioned that Bangladesh’s apparel industry has demonstrated resilience in dealing with adverse situations over the past 40 years.

“We have garment, textile, and accessory facilities in close proximity, which is a comparative advantage over other countries,” he said.

“Our workers are using their maximum physical ability but they are not able to compete with China as they are using fully automated machinery. Workers are multi-tasking; they can operate various machines,” Shofiqur Rahman added