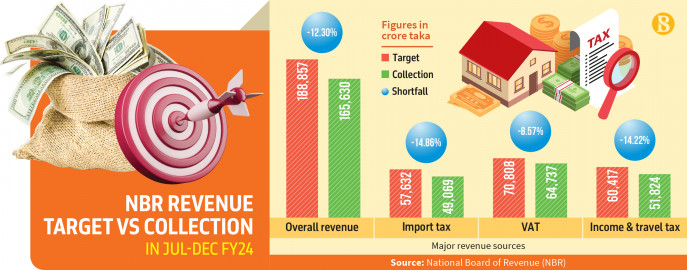

Tk23,000cr revenue shortfall in H1 FY24

The National Board of Revenue has ended the first half of the current fiscal year with a revenue collection of Tk1,65,629 crore, witnessing a shortfall of Tk23,227 crore against its target.

Economists suggest that there is a slight downturn in the economy. Along with this, imports have decreased due to the dollar crisis, due to which the expected revenue of Tk1,89,000 crore has not been realised. Amid this, the significant deficit is a consequence of the high revenue target assigned to the NBR.

Towfiqul Islam Khan, a senior research officer at the Centre for Policy Dialogue, told, “The ambitious target was given to NBR based on wrong assumptions, which resulted in a big deficit compared to the target.”

He recommended revising the target, saying, “The chances of achieving this target are very low.”

Former NBR Chairman Mohammad Abdul Mazid told, “Like in previous years, a huge budget along with a big revenue target was declared this year, and that is why there seems to be a big gap.”

He observes that NBR should have been able to collect revenue at a higher rate.

The government has been discouraging imports for more than a year due to the dollar crisis and major devaluation of the taka. Data from Bangladesh Bank suggests that letter of credit (LC) settlement has decreased by 18% in the first half of the current financial year. LC settlement basically dictates the reduction of imports.

As a result, there is no expected momentum in the collection of import duty. In the last six months, the growth in this sector has been 9%, which is mainly due to the devaluation of the taka against the dollar, experts believe.

NBR’s overall revenue collection in the last six months has grown by about 14% compared to the corresponding period of the previous financial year, which is mainly due to the increase in tax on some products and inflation last year, experts said.

As per NBR data, 38% of the total revenue target for the current fiscal year has been collected in the last six months. As such, to achieve the target, 62% of the revenue has to be collected in the remaining six months.

NBR Chairman Abu Hena Md Rahmatul Muneem observes that it will be challenging to meet the revenue collection target set by the International Monetary Fund for Bangladesh.

“Collection of revenue as per IMF target will be a challenge. But we are taking some strategy, and we take it as a challenge,” he said during a press briefing at the board on Thursday.

NBR’s revenue target for the current fiscal year is Tk4.30 lakh crore, up by Tk1 lakh crore from the revenue collection last fiscal year. To achieve the target, NBR needs revenue growth of around 30%. Data from NBR suggests that such a high rate of revenue has not been collected in Bangladesh in any year after the country’s independence.

According to NBR data, its revenue collection has grown at an average rate of less than 11% over the past five years.

Meanwhile, the government’s bank debt has also increased due to the shortfall in revenue compared to the target. In addition, there has been a slow pace in the implementation of the government’s development projects.

According to the Implementation Monitoring and Evaluation Division under the Ministry of Planning, the implementation of the annual development programme in the five months from last July to November was only 17%, which is the lowest in the same period in the last six years.

According to NBR data, import duty collection increased by a little over 9%. At the same time, VAT and income tax collections increased by 16% respectively.

NBR to observe Int’l Customs Day today

In observance of International Customs Day, NBR will hold a seminar at the Revenue Building in the capital’s Agargaon today.

Finance Minister Abul Hassan Mahmood Ali is expected to attend the seminar.

The slogan of this year’s Customs Day is “Customs Engaging Traditional and New Partners with Purpose”.

At a press conference, the NBR chairman highlighted the activities of the board on the occasion of the day.