From food to fashion, Bangladesh sees consumption crunch

Retailers have pointed to a particularly steep decline since July, saying inflation is eroding household budgets, leaving many families prioritising essentials over discretionary spending

From groceries to clothing to personal care items, demand is plummeting across the board in Bangladesh, and retail industry experts warn that even brief signs of recovery are waning due to fresh downturns.

Retailers have pointed to a particularly steep decline since July, saying inflation is eroding household budgets, leaving many families prioritising essentials over discretionary spending. Sales of protein-rich foods like chicken and fish, which are more affordable compared to mutton and beef, have dropped by at least one-third in October compared to the previous month.

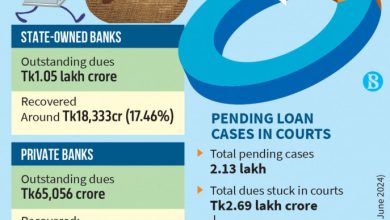

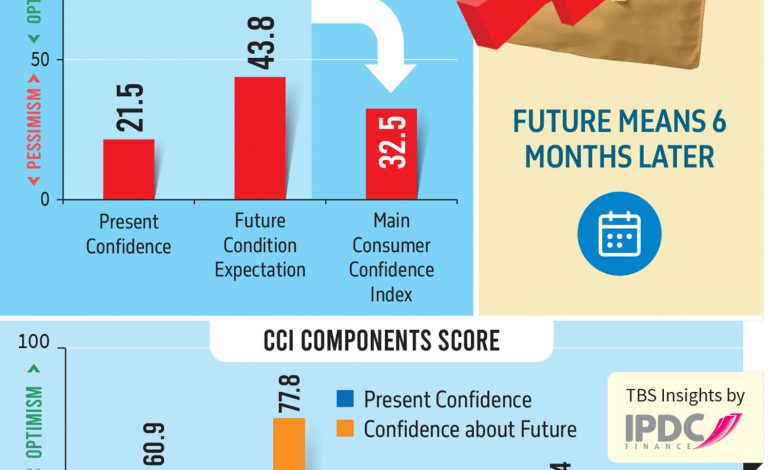

A Consumer Confidence Index (CCI), a survey recently conducted by the country’s largest supermarket chain Shwapno, paints a grim picture, reflecting widespread pessimism about personal finances and the overall economy.

The Shwapno CCI, modelled on a consumer sentiment survey developed by the Organisation for Economic Co-operation and Development, stood at a meagre 32.5 in early October, indicating consumers’ deep concerns about their current situation and future outlook, as readings below 50 signal pessimism.

The present condition index is particularly low at 21.5, while the future condition index – though higher at 43.8 – still falls short of indicating optimism.

The survey, which polled over 330 consumers from diverse backgrounds, found that households are especially frustrated with their spending ability, both now and looking six months ahead. The Household Spending Ability index, which combines these sentiments, registered an alarming score of just 1.

Consumers’ perceptions of the price level were similarly bleak, with the index standing at 7, as they remain squeezed by the relentless rise in the cost of essentials.

Although the household income confidence index read at 36.2, reflecting some stability in earnings, the lower score of 30.7 for household financial condition suggests that income gains are being outpaced by inflation.

Overall, none of the indicators reached the optimistic threshold, with the national economic sentiment index stuck at 39.

Regions such as Rajshahi, Sylhet, Chattogram, and Dhaka were the most pessimistic, all reporting CCI scores below 30. In contrast, Rangpur stood out as an outlier with a score of 54.6, indicating relatively stronger consumer confidence.

Political instability was blamed by 47.5% of respondents for their economic struggles, while 29.9% cited the broader economic situation. Other factors, such as law and order and natural disasters, were seen as secondary concerns.

Infographics: TBS

Consumption slowdown

Homegrown PRAN Group, controlling 25%-30% of the country’s food products market, was seeing a double-digit annual sales growth and now it is facing hardship in retaining sales.

Demand in many of the segments is subdued as consumers are under pressure to prioritise their spending, said its Marketing Director Kamruzzaman Kamal.

The growth is yet to turn negative for PRAN, thanks to its wide, diverse product range of around 800 items including bread, biscuits, puffed rice, spices, noodles, chocolates, milk and a wide range of beverages.

Nature of the products, regular addition of new items and consumer-centric pricing together helped PRAN avert negative sales growth, added Kamruzzaman.

However, the situation is significantly worse for many other consumer products as people are increasingly compelled to forgo even basic essentials to afford the necessities.

Baby food sales drop by 5%-20%

For instance, multinational Nestlé with its around Tk4,000 crore annual turnover controls 60% of Bangladesh’s baby food market along with market leadership in coffee, noodles and chocolate segments.

After the fall of the Awami League government on 5 August, Nestlé Bangladesh’s sales dropped by 5%-20%, according to its Corporate Affairs Director Debabrata Roy.

“Baby food sales have been declining for the past two years due to inflation. The recent political instability has worsened the situation, resulting in negative sales growth,” he told TBS.

Switching to cheaper alternatives

Unilever Bangladesh, the market leader in soap, shampoo, and cosmetics, supplies more than 50% of the country’s personal care products and the company is also observing a weaker demand and downshifting to cheaper products.

Zaved Akhtar, chairman of Unilever Bangladesh, said the country’s fast-moving consumer goods (FMCG) market has been declining for more than a year amid an inflationary environment. “Although the rate of decline has slowed, it is still decreasing by 5%,” he told TBS.

In a previous interview with TBS, he had said sales of premium products such as high-end soaps, shampoos, lotions, facial creams, and detergents have decreased, while demand for mini packs and cheaper alternatives has increased.

He explained that Surf is their highest-quality and most expensive detergent brand, compared to Rin and Wheel. Due to reduced purchasing power, many consumers have switched from Surf to the more affordable Rin.

At the same time, sales of Wheel’s mini packs rose. Similarly, consumers are increasingly opting for Tk3-5 mini-packs instead of buying large shampoo bottles.

Horlicks consumption keeps declining

The story is similar for Horlicks seller Unilever Consumer Care Ltd. Its annual sales dropped to 5,433 tonnes in 2023 from 7,371 tonnes in 2021.

Regarding the sales decline of large packs or jars of Horlicks, Unilever Consumer Care Chairman Masud Khan said the company promoted mini packs and reached more households across the country in 2022 and 2023.

However, consumers tightening their belts amid price hikes made it difficult to avert the quantity declines, while upward price adjustments amid rising costs, operational efficiency and higher financial income helped it retain profits.

The shrink in consumption of the most popular health food drink product continued in the first six months of this year too, as the half-yearly sales dropped to 2,264 tonnes from 2,428 tonnes in the same period last year, according to the company’s financial statements.

“Earlier this year, the company was seeing several months of recovery and again the recovery slowed down again amid steep inflation,” said Masud.

Supermarkets compromise profitability to retain sales

“Limited income people are struggling to cope with the repeated spikes in essential commodities prices,” said Shameem Ahmed Jaigirdar, chief operating officer of supermarket chain Meena Bazar.

Supermarket chains are significantly compromising their profit margin to retain sales alongside acting as a market cooling agent, he said, adding that offering discounts on eggs and vegetables is helping attract customers.

Higher prices might be retaining retail turnover, but consumers are buying less in quantity terms, he added.

For instance, he said, a 20% inflation in the vegetable segment resulted in a 10% volume drop for his chain.

Sales in the rich neighbourhoods are less impacted, while consumers’ struggles in average-income areas are apparent, according to him.

Sabbir Hasan Nasir, managing director of Shwapno, operating nationwide with over 500 outlets, said an increasing number of customers are dropping off their favourite health-friendly food, or various premium items from the carts as they are being forced to stay within their tight budget.

Shifting to necessities and cheaper alternatives is a common tendency observed during tough times, according to him.

For instance, he said, sales of imported apple cider vinegar, premium coconut oil, sunflower oil or various nuts nosedived after several years of rising demand.

“To save some bucks, many people are buying loose commodities instead of the assorted packets,” he said, adding that premium personal care products, lifestyle products, and general merchandise sales nosedived.

Not spending on shoes like before

Dilip Kajuri, deputy managing director of Apex Footwear, said consumers’ struggle has been apparent for the past two years and they have turned more conservative in recent weeks.

Apex Founders Day in late September is a big discount day for the brand that attracts huge customers to the Apex outlets across the country. This year the sales festival was extended by a day due to bad weather and then the sales slightly surpassed that in the previous year’s Founders Day sales.

Other than major festivals, most consumers are rethinking their shoe purchases until their ones need a replacement or there is a big discount.

Most people nowadays end up buying cheaper shoes. For instance, he said, “A regular customer who was buying shoes worth over Tk5,000 for years is buying a pair worth Tk3,000-3,500 nowadays and this is the story of the majority of customers.”

He added, “Cheaper alternatives are helping us to retain the sales volume.”

Fashion sales halved

Soumik Das, CEO of fashion house Rang Bangladesh, told TBS that shopping from India or buying Indian dress from local markets has almost stopped in recent weeks and that helped a few well-prepared brands retain Durga Puja sales. But, sales after the festival nosedived again as people are prioritising their needs amid high inflation.

Fashion wear sales almost halved compared to regular months, as footfall in the fashion outlets also dropped to half, said Azharul Haque Azad, president of the Fashion Entrepreneurs Association of Bangladesh.

September-October sales in the sector seemed to have been the lowest since 2021, said Azad, who is the founder of another popular fashion house – Shada Kalo.

Echoing him, Kay Craft Managing Partner Khalid Mahmood Khan said, “We don’t want to compare this unusual time with regular seasons. But, the businesses, on their way to recovery, are repeatedly facing issues.”

Fish and chicken sales slump

It’s not just consumers cutting back on shoes, clothes, or fruits; spending on protein-rich foods like chicken and fish, typically more affordable than mutton and beef, has also declined.

Mohammad Razzaq, a fish seller at New Eskaton for over a decade, said he has never seen such a drop in sales.

“I bought Tk45,000 worth of fish, mostly ruhi, as it’s cheaper than other types. It’s now 12:30pm, and with only an hour left before closing, more than 50% of the fish remain unsold,” Razzaq said.

He estimates that sales have fallen by at least one-third in October compared to the previous month. Razzaq attributes this to rising prices, noting that the price of ruhi has surged by Tk50 per kilogram, now costing Tk400. “A customer needs at least Tk1,000 to buy a fish. They ask the price and walk away. My expenses are getting bigger than my income,” he added.

Nearby, Rahim, a chicken seller, was seen pleading with a potential customer to buy some chicken.

“I’ve only sold nine chickens today, compared to the 20 to 30 I used to sell,” a frustrated Rahim said.