Dollar pressure rises as short-term foreign debt drops $300m in October

Bangladesh’s foreign reserves have fallen by $3.7 billion in just three months

Due to the rising interest rate of the dollar in the international market and continuous increase in dollar rate, the short-term foreign debt of the private sector fell by $300 million in October, putting fresh pressure on the dollar liquidity and dwindling forex reserves in the country.

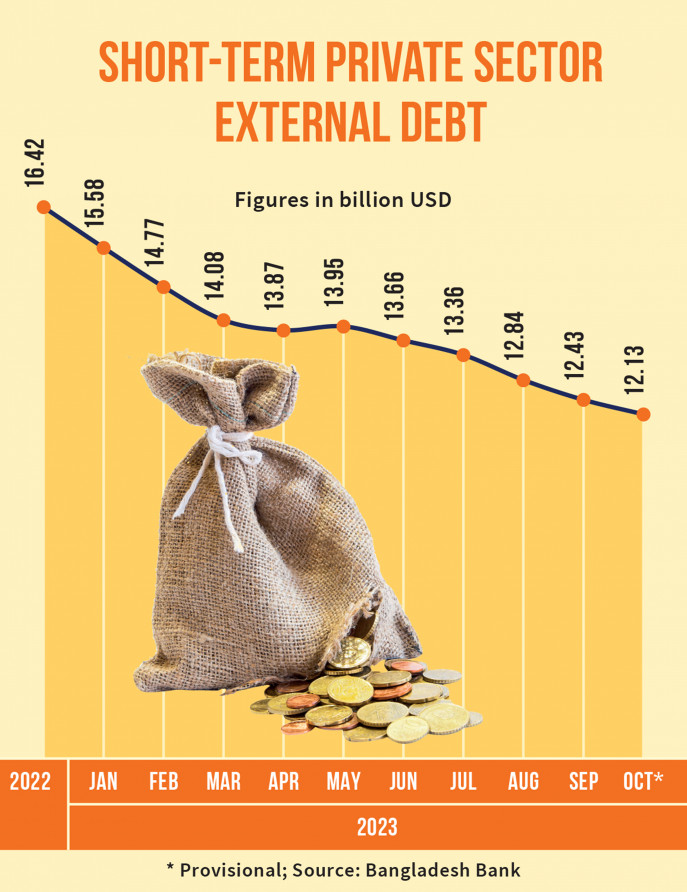

According to the central bank, the short-term private sector foreign debt stood at $12.13 billion at the end of October. It was $12.43 billion at the end of September.

According to Bangladesh Bank data, at the end of December 2022, the outstanding short-term foreign loans taken by the country’s private sector from various foreign banks and institutions was $16.42 billion. But within a span of 10 months, it has decreased by nearly $4.29 billion. Out of these payments, $525 million was paid as interest.

A senior central bank official told, “In the past 10 months, we have experienced a significant decline in our forex reserves. One of the reasons for this is the reduction in short-term foreign loans in the private sector. Imports were funded through these short-term loans. The current decrease in imports has also led to a somewhat reduced demand for these loans.”

According to the central bank, Bangladesh’s foreign reserves have fallen by $3.7 billion in just three months, from $23.09 billion at the end of August to $19.40 billion now.

Md Habibur Rahman, chief economist of the Bangladesh Bank told, “The interest rate of the dollar has significantly increased compared to before. Besides, borrowers are also keeping in mind the issue of exchange rate risk. As a result, they are making more loan repayments, which is increasing the pressure on our balance of payment and reserves.”

More than 8.5% interest has to be paid for these short-term foreign loans. There is a rule to pay the maximum Secured Overnight Financing Rate (SOFR) plus 3.5% interest against foreign loans. SOFR is now over 5%. In 2020, it was below 1%.

The SOFR is a benchmark interest rate for dollar-denominated derivatives and loans that replaced the London Interbank Offered Rate.

According to central bank data, the taka has been devalued by around 6% over the last one year. However, bankers say the value of the currency has fallen more than the central bank announced. As an example, they say, the central bank is currently selling dollars from reserves at the rate of Tk110.25, but importers are buying dollars at the maximum rate of Tk128. The difference here is more than Tk17. Due to the devaluation of the currency, borrowers are required to buy dollars at a higher rate to repay their loans. There is concern among business people that the value may further decrease in the future.

Apart from this, other costs of taking loans are also increasing. Now 20% tax is payable on foreign loan interest. Interest rates on loans have already increased. Taxes add an extra 1.7%, making the net interest over 10.2%. Businessmen are not interested in taking loans by paying so much interest, say bankers.

Emranul Huq, managing director and chief executive officer of Dhaka Bank told, “It’s not just the demand for loans, but the supply is also not as readily available as before. The loan limits of many foreign banks have decreased. Previously, when we repaid old loans, they would disburse new loans. Now, that is not happening. In other words, our available loans have decreased.”

According to the central bank data, new loans amounting to $2.05 billion were obtained in October, whereas businesses repaid loans totalling $2.41 billion with interest.

Arfan Ali, former MD of Bank Asia, said, “Due to the deterioration of our credit ratings in comparison to before, many foreign banks are now unwilling to lend to us as they did before. Additionally, some banks, failing to repay loan amounts in a timely manner, have caused us reputational damage. Consequently, the disbursement of new loans is decreasing. Furthermore, with the decline in LC (Letter of Credit) openings, there has been a slight reduction in the demand for loans compared to before.”